Your advice please

#1

Junior Member

Thread Starter

Your advice please

Many months ago I ordered a 2019 S560 because I couldn't find one with the exact specifications I wanted. It is now at my dealership. I need to decide whether to (1) buy or lease it and (2) whether to get my deposit back and buy or lease a different car.

As to (1). The MSRP of the car is about 110,000. I got a little over 10% off of that, so the purchase would be about $100,000. I I have enough to pay cash without breaking the bank, but am not sure I want to spend my cash account down that much. I have been offered (by a credit union) a loan of 60 months at 3.69%. If I put $20,000 down and paid the tax (another $10,000) in cash, I would have a monthly payment of $1447. After three years, I would have paid $52,092 in monthly payments plus $30,000 up front, and still owe $33,350, for a total outlay of $115,442 to own the car. Mercedes terns for purchase are not as good. On the other hand, my dealer wants to lease it to me for 3 years with nothing down. They have a program they call "multiple security deposit", whereby I give them a check up front for 10 times the monthly lease payment and Mercedes holds that money and gives it all back to me (without interest) at the end of the lease. Under this program my monthly payment (including tax) would be $1864, so my multiple security deposit would be $18,640 dollars. The "money factor" would be .00104 - an interest rate, I'm told, of 2.49%. The residual, assuming 15,000 miles per year, would be $48,657. There is a "lease turn in" fee of $638. So, after three years I would have paid $67,104 in monthly payments plus $638 = $67,742, and it would then cost me $48,657 to buy the car, for a total outlay of $116399. Of course, I could also turn it in and lease another new car. But I generally keep a car for much more than three years. Incidentally, my dealer has not yet told me what they will give me in trade-in for my mint 2003 SL500, so that still has to be negotiated.

As to (2). At the time I was shopping (very early this year) I was also interested in an SUV, but felt that neither the GLE or the GLS were close to the S560 in refinement. Now there are new models of both if I am prepared to wait six months or more longer. The GLE580 looks like a desirable midsize that will be available for a short time, and the GLS580 looks good, with basically the same interior as the GLE. Both would be new 2020 models with MBUX as opposed to Command in the S560. My deposit on the S560 is fully refundable.

I am retired, so don't commute. My driving consists of short trips around town and travel, sometimes with two dogs and some golf clubs. I think the dogs, who are small, are actually more comfortable sitting in the back seat of a sedan than on the hard backs of folded-down seats in an SUV, which are not really level in the folded position.

So, what would you do?

As to (1). The MSRP of the car is about 110,000. I got a little over 10% off of that, so the purchase would be about $100,000. I I have enough to pay cash without breaking the bank, but am not sure I want to spend my cash account down that much. I have been offered (by a credit union) a loan of 60 months at 3.69%. If I put $20,000 down and paid the tax (another $10,000) in cash, I would have a monthly payment of $1447. After three years, I would have paid $52,092 in monthly payments plus $30,000 up front, and still owe $33,350, for a total outlay of $115,442 to own the car. Mercedes terns for purchase are not as good. On the other hand, my dealer wants to lease it to me for 3 years with nothing down. They have a program they call "multiple security deposit", whereby I give them a check up front for 10 times the monthly lease payment and Mercedes holds that money and gives it all back to me (without interest) at the end of the lease. Under this program my monthly payment (including tax) would be $1864, so my multiple security deposit would be $18,640 dollars. The "money factor" would be .00104 - an interest rate, I'm told, of 2.49%. The residual, assuming 15,000 miles per year, would be $48,657. There is a "lease turn in" fee of $638. So, after three years I would have paid $67,104 in monthly payments plus $638 = $67,742, and it would then cost me $48,657 to buy the car, for a total outlay of $116399. Of course, I could also turn it in and lease another new car. But I generally keep a car for much more than three years. Incidentally, my dealer has not yet told me what they will give me in trade-in for my mint 2003 SL500, so that still has to be negotiated.

As to (2). At the time I was shopping (very early this year) I was also interested in an SUV, but felt that neither the GLE or the GLS were close to the S560 in refinement. Now there are new models of both if I am prepared to wait six months or more longer. The GLE580 looks like a desirable midsize that will be available for a short time, and the GLS580 looks good, with basically the same interior as the GLE. Both would be new 2020 models with MBUX as opposed to Command in the S560. My deposit on the S560 is fully refundable.

I am retired, so don't commute. My driving consists of short trips around town and travel, sometimes with two dogs and some golf clubs. I think the dogs, who are small, are actually more comfortable sitting in the back seat of a sedan than on the hard backs of folded-down seats in an SUV, which are not really level in the folded position.

So, what would you do?

#2

MBWorld Fanatic!

You will get two schools of thought from these boards from what I have seen. Some, like me will tell you to go find a nice 2-3 year old example with sub 20K miles for 50-60K and save a bunch of money by purchasing used with an extended warranty. Others will say, buy what you want, even if it means you lose 30-40K in value in the first two years. It all depends on your financial situation. If you can go out and buy the car you want new and it does not effect your financial position to bad then I would say go for it, you only live once and you know what you have. If you are stretching to buy a new car in retirement, than you are probably not a candidate to spend 100K on a new car. Only you know your financial position. On the car vs SUV question, I prefer the ride and quietness of the S class but as I get older I like the entry access of an SUV. My next car will probably be a Range Rover based on the legroom and the fact that is is comparable to the S class in ride comfort and quietness.

#3

Super Moderator

Join Date: May 2002

Location: Land of 10,000 lakes

Posts: 9,984

Received 3,171 Likes

on

1,977 Posts

AMG GTC Roadster, E63s Ed.1, M8 Comp. Coupe

You can go used as superpop mentioned; there are lots of quality cars available.

If you like to get a new car based on your example, the lease makes more sense as it allows you to walk away from the car with zero cost over financing. MB will obviously waive the turn-in fee and you can get out of the lease into another lease 5 month early without any issues. With the fast changing technology and new electric luxury cars coming into play over the coming years, the actual depreciation of the S-Class is unknown. The lease provides a hedge against depreciation.

Cash: Strongly recommend against using cash for a depreciating asset.

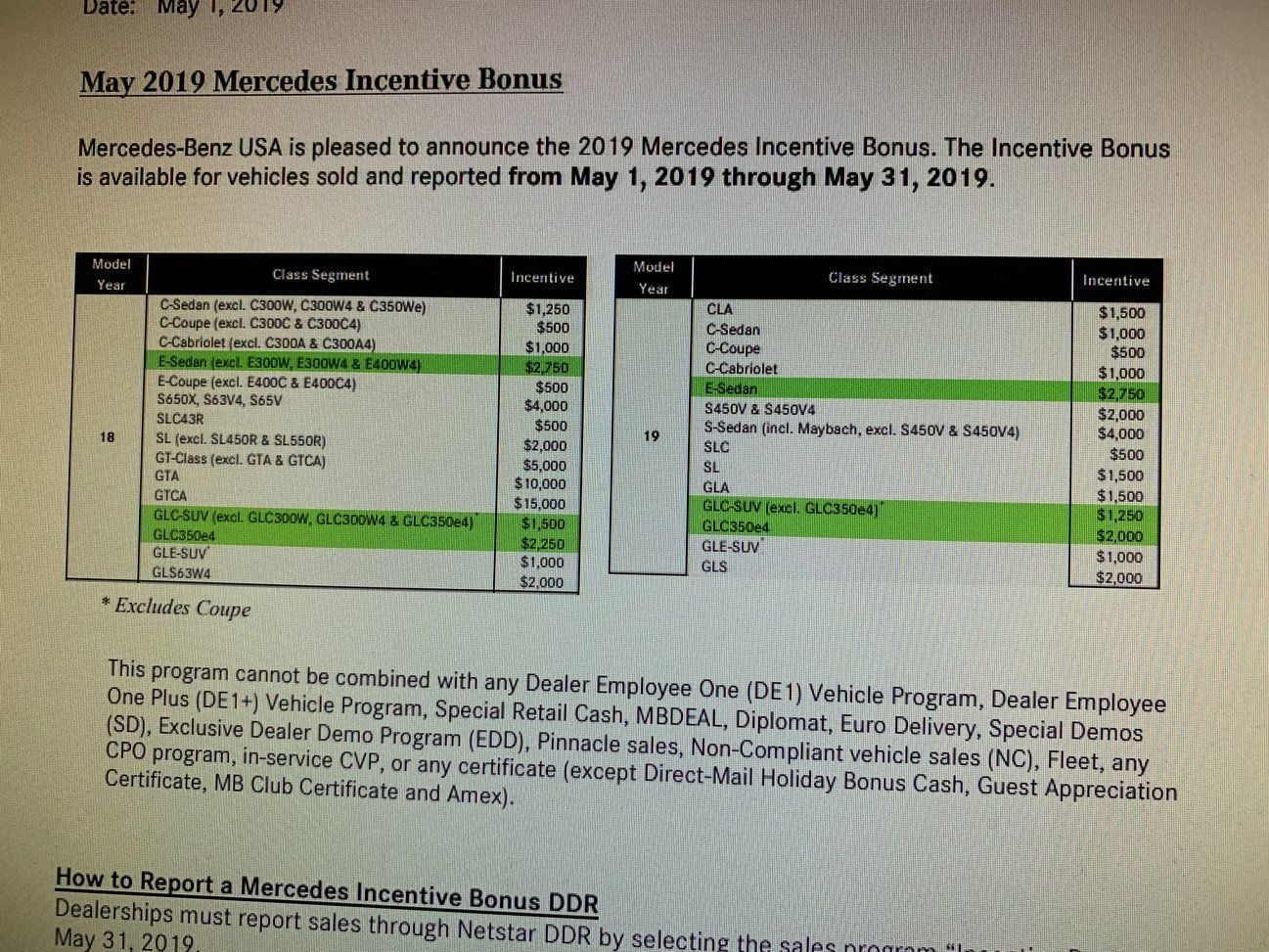

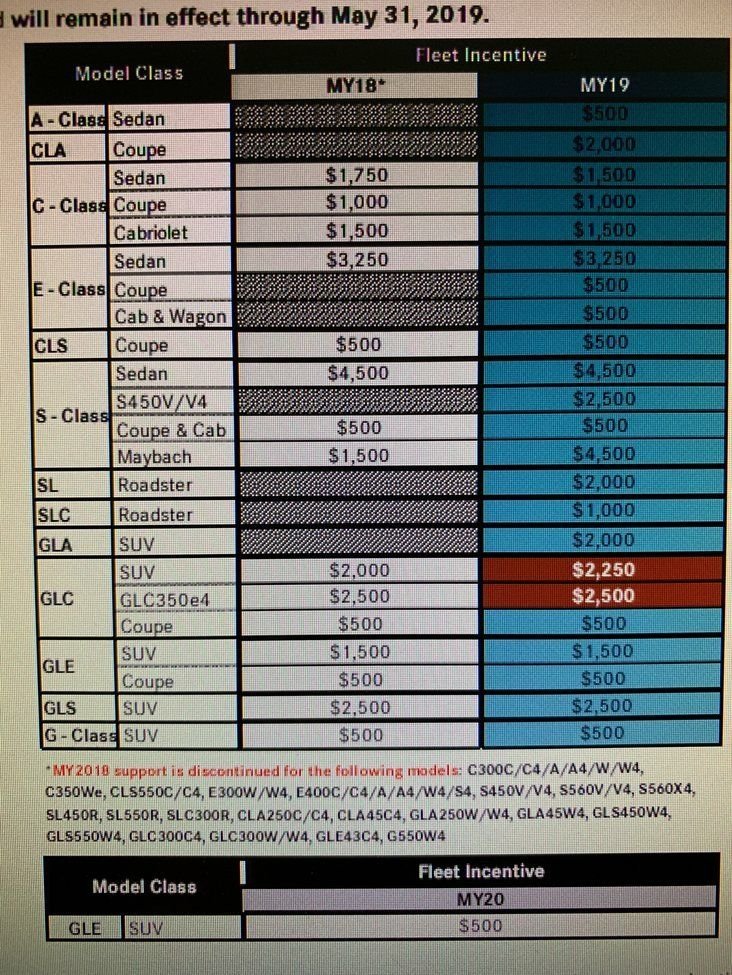

Price: You can get $8500 off in incentives on the S-Class without the dealer even giving you a discount. Ask the dealer exactly which incentives he applied to arrive at the $10k discount (he/she may not want to). Have them be specific. This way if they forget any incentives you can make them apply it as well. From an actual discount perspective without incentives, I would think you can discount between 7% (invoice) -12% (+ hold back), so a 15%+ total discount is what I would go for...

Trade-In: I would expect something around $10k for the SL if very low miles. Keep it or sell it privately if the number is too low for you...

If you like to get a new car based on your example, the lease makes more sense as it allows you to walk away from the car with zero cost over financing. MB will obviously waive the turn-in fee and you can get out of the lease into another lease 5 month early without any issues. With the fast changing technology and new electric luxury cars coming into play over the coming years, the actual depreciation of the S-Class is unknown. The lease provides a hedge against depreciation.

Cash: Strongly recommend against using cash for a depreciating asset.

Price: You can get $8500 off in incentives on the S-Class without the dealer even giving you a discount. Ask the dealer exactly which incentives he applied to arrive at the $10k discount (he/she may not want to). Have them be specific. This way if they forget any incentives you can make them apply it as well. From an actual discount perspective without incentives, I would think you can discount between 7% (invoice) -12% (+ hold back), so a 15%+ total discount is what I would go for...

Trade-In: I would expect something around $10k for the SL if very low miles. Keep it or sell it privately if the number is too low for you...

Last edited by Wolfman; 07-09-2019 at 04:32 PM.

#4

Junior Member

Thread Starter

Thank you both for the responses. Wolfman - I am not sure that I agree as to the zero cost over financing. It is true that after three years I could walk away from the lease. However, at that point I would have paid $67,742, plus tying up $18,640 for the three years. Whereas, buying it, after three years I would still own the car and have an obligation to continue to pay, but I would only owe $33,350 - which means, I think, that I would have some equity in the car. I think I could sell a 3 year old S560 for more than that. And my monthly payments over the three years would be lower ($1447 versus $1864).

How do I find out about the $8500 in incentives? I would like to know about them before I talk again with the dealer. Is there a site which provides that information?

I have almost always bought my cars used. However, I much prefer the S560 to the S550, so would be probably have to find a 2018 S560. I am very particular about options and colors, so it would be a difficult search. I have not found one I would buy after looking for more than a year.

The 2003 SL500 has 50,000 miles and looks new. If the dealer has incentives it can apply, and I know about them, I guess that might affect what they would give me on the trade.

Your thoughts are much appreciated.

How do I find out about the $8500 in incentives? I would like to know about them before I talk again with the dealer. Is there a site which provides that information?

I have almost always bought my cars used. However, I much prefer the S560 to the S550, so would be probably have to find a 2018 S560. I am very particular about options and colors, so it would be a difficult search. I have not found one I would buy after looking for more than a year.

The 2003 SL500 has 50,000 miles and looks new. If the dealer has incentives it can apply, and I know about them, I guess that might affect what they would give me on the trade.

Your thoughts are much appreciated.

#5

There are <almost> no financing terms (buy or lease) where you spend less money <long term> than just buying the car.

There are terms by which you make money on the money you leave in "the bank" and this offsets finance charges.

You have to be good in money matters and finance to even break even.

I am not that good in MM and F so I buy my cars.

There are terms by which you make money on the money you leave in "the bank" and this offsets finance charges.

You have to be good in money matters and finance to even break even.

I am not that good in MM and F so I buy my cars.

#6

MBWorld Fanatic!

Have you considered a one payment lease? Since I despise monthly payments that's the rout I took. The dealer offered about $42K on a trade-in for my 2014 S550 with about 57K miles on it (don't remember the exact mileage). I put down about $12K and now I'm free to do what I want at the end of the 3 year lease. As Wolfman stated, technology is changing so fast that I will probably lease a new S Class if I wish in the fall of 2021.

#7

Super Moderator

Join Date: May 2002

Location: Land of 10,000 lakes

Posts: 9,984

Received 3,171 Likes

on

1,977 Posts

AMG GTC Roadster, E63s Ed.1, M8 Comp. Coupe

Thank you both for the responses. Wolfman - I am not sure that I agree as to the zero cost over financing. It is true that after three years I could walk away from the lease. However, at that point I would have paid $67,742, plus tying up $18,640 for the three years. Whereas, buying it, after three years I would still own the car and have an obligation to continue to pay, but I would only owe $33,350 - which means, I think, that I would have some equity in the car. I think I could sell a 3 year old S560 for more than that. And my monthly payments over the three years would be lower ($1447 versus $1864).

How do I find out about the $8500 in incentives? I would like to know about them before I talk again with the dealer. Is there a site which provides that information?

I have almost always bought my cars used. However, I much prefer the S560 to the S550, so would be probably have to find a 2018 S560. I am very particular about options and colors, so it would be a difficult search. I have not found one I would buy after looking for more than a year.

The 2003 SL500 has 50,000 miles and looks new. If the dealer has incentives it can apply, and I know about them, I guess that might affect what they would give me on the trade.

Your thoughts are much appreciated.

How do I find out about the $8500 in incentives? I would like to know about them before I talk again with the dealer. Is there a site which provides that information?

I have almost always bought my cars used. However, I much prefer the S560 to the S550, so would be probably have to find a 2018 S560. I am very particular about options and colors, so it would be a difficult search. I have not found one I would buy after looking for more than a year.

The 2003 SL500 has 50,000 miles and looks new. If the dealer has incentives it can apply, and I know about them, I guess that might affect what they would give me on the trade.

Your thoughts are much appreciated.

Keep in mind that you can't compare monthly lease to financing rates if you are putting $20k/$30k down on the car and zero on the lease

MSD's is interest bearing money, so that's a free discount plus either way.

MSD's is interest bearing money, so that's a free discount plus either way.Also, depending on the state you live in, the sales tax on a lease might only be based on the partial value (net - residual) rather than the whole value of the car.

On the SL, with 50K miles the trade-in value is ($9k-$11k).

Re. the incentives, I don't have the July numbers but these were the May numbers. July would typically be same/better...

Last edited by Wolfman; 07-09-2019 at 09:13 PM.

Trending Topics

#8

Member

Regarding a lease, a great source for education and a detailed lease calculator is leaseguide.com. A great source for current lease information are the Edmunds forums. You probably know this, but the only lease number you can really negotiate is the Capital Cost. Money factor and residual is set by the lease company. The Capital Cost should be your negotiated purchase price, less most, if not all, of any dealer lease incentives.

An example of the July numbers from the Edmunds forum for a 560 4matic 36 mo/12k is a money factor of .00104, a residual of 46% of MSRP, and a $10,000 dealer lease incentive. You can post the specific vehicle and lease terms you are interested in and a moderator will provide info.

My guess is that with the lease, the dealer is setting a capital cost higher than your purchase price and keeping the $10k incentive (which is why he wants you to lease). Get the dealer to give you the Capital Cost he is using, plus any fees and plug info into the Lease Guide calculator with your state's tax rate and see what you get.

There are cases when leasing may be better even if you are interested in keeping the vehicle. I have a leased Acura MDX Advance with another year, but am considering rolling into a new lease later in the year as Acura currently has an $8,500 dealer lease incentive, but only a $2,500 purchase incentive. The incentives should increase when the 2020s come out. This on a $59,000 MSRP SH-awd/Advance Trim.

An example of the July numbers from the Edmunds forum for a 560 4matic 36 mo/12k is a money factor of .00104, a residual of 46% of MSRP, and a $10,000 dealer lease incentive. You can post the specific vehicle and lease terms you are interested in and a moderator will provide info.

My guess is that with the lease, the dealer is setting a capital cost higher than your purchase price and keeping the $10k incentive (which is why he wants you to lease). Get the dealer to give you the Capital Cost he is using, plus any fees and plug info into the Lease Guide calculator with your state's tax rate and see what you get.

There are cases when leasing may be better even if you are interested in keeping the vehicle. I have a leased Acura MDX Advance with another year, but am considering rolling into a new lease later in the year as Acura currently has an $8,500 dealer lease incentive, but only a $2,500 purchase incentive. The incentives should increase when the 2020s come out. This on a $59,000 MSRP SH-awd/Advance Trim.

#9

Super Moderator

Join Date: May 2002

Location: Land of 10,000 lakes

Posts: 9,984

Received 3,171 Likes

on

1,977 Posts

AMG GTC Roadster, E63s Ed.1, M8 Comp. Coupe

Regarding a lease, a great source for education and a detailed lease calculator is leaseguide.com. A great source for current lease information are the Edmunds forums. You probably know this, but the only lease number you can really negotiate is the Capital Cost. Money factor and residual is set by the lease company. The Capital Cost should be your negotiated purchase price, less most, if not all, of any dealer lease incentives.

An example of the July numbers from the Edmunds forum for a 560 4matic 36 mo/12k is a money factor of .00104, a residual of 46% of MSRP, and a $10,000 dealer lease incentive. You can post the specific vehicle and lease terms you are interested in and a moderator will provide info.

My guess is that with the lease, the dealer is setting a capital cost higher than your purchase price and keeping the $10k incentive (which is why he wants you to lease). Get the dealer to give you the Capital Cost he is using, plus any fees and plug info into the Lease Guide calculator with your state's tax rate and see what you get.

There are cases when leasing may be better even if you are interested in keeping the vehicle. I have a leased Acura MDX Advance with another year, but am considering rolling into a new lease later in the year as Acura currently has an $8,500 dealer lease incentive, but only a $2,500 purchase incentive. The incentives should increase when the 2020s come out. This on a $59,000 MSRP SH-awd/Advance Trim.

An example of the July numbers from the Edmunds forum for a 560 4matic 36 mo/12k is a money factor of .00104, a residual of 46% of MSRP, and a $10,000 dealer lease incentive. You can post the specific vehicle and lease terms you are interested in and a moderator will provide info.

My guess is that with the lease, the dealer is setting a capital cost higher than your purchase price and keeping the $10k incentive (which is why he wants you to lease). Get the dealer to give you the Capital Cost he is using, plus any fees and plug info into the Lease Guide calculator with your state's tax rate and see what you get.

There are cases when leasing may be better even if you are interested in keeping the vehicle. I have a leased Acura MDX Advance with another year, but am considering rolling into a new lease later in the year as Acura currently has an $8,500 dealer lease incentive, but only a $2,500 purchase incentive. The incentives should increase when the 2020s come out. This on a $59,000 MSRP SH-awd/Advance Trim.

This is actually incorrect.

The only fixed number is residual. Money factor is a key negotiation point in a lease. MF is marked up to a retail rate. Even the base rates shown on Edmunds forums are the base retail rates, not the buy rates. In addition to the markup the rates are based on the customer credit tiers.

Last edited by Wolfman; 07-10-2019 at 01:12 PM.

#10

Member

This is actually incorrect.

The only fixed number is residual. Money factor is a key negotiation point in a lease. MF is marked up to a retail rate. Even the base rates shown on Edmunds forums are the base retail rates, not the buy rates. In addition to the markup the rates are based on the customer credit tiers.

The only fixed number is residual. Money factor is a key negotiation point in a lease. MF is marked up to a retail rate. Even the base rates shown on Edmunds forums are the base retail rates, not the buy rates. In addition to the markup the rates are based on the customer credit tiers.

#11

Super Moderator

Join Date: May 2002

Location: Land of 10,000 lakes

Posts: 9,984

Received 3,171 Likes

on

1,977 Posts

AMG GTC Roadster, E63s Ed.1, M8 Comp. Coupe

While I have seen on various forums where dealers have tried to plug in a higher rate than that offered by the manufacturer's finance arm, why would anyone that knows the base money factor pay a higher rate? This is where research is important. Personally, I have never had a dealer try to increase the base rate, and over the years I have had leases from Acura, Lexus, & GM.

Financing is a profit center for car dealers...

Mercedes MF markup is based on a revenue sharing model between the dealer and MBFS (It's a 70/30 split calculated from difference between the customer, dealer and dealer reserve MF) This monthly reserve is multiplied by the lease period and paid out to the dealer post sale.

So the profit is in marking up the MF.

Whatever you see on Edmunds is not the lowest rate.

The S-Class variances are smaller as the car has a subvented rate which is a fraction of the standard MF rate. If you try to lease a higher-end AMG, your base MF maybe .0028 but dealers can take that rate to .0033 if they wish even if the customer is Tier1. Mercedes will even print rate sheets with the higher rates if desired. Dealers even will tell you as much if the sell a car at a good discount. "This is the only way we get some money on the sale"

Rate change on the customers credit tiers. AFAIK the base is a Tier1 rate. MBFS has an auto approve function for their good customers that are typically below the .0002 below the base.

Normally the MF gets reviewed/updated every 30 days, residuals every 60.