Update on leasing 2022 E Class

#26

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Actually no. Here's what none of you understand. It costs carmakers money to sell cars. Not just advertising dollars but money in programs to help sell cars.

I keep bringing up GM because they were the biggest carmaker in the world and went bankrupt. Why? Because they had to spend so much money trying to move the too many cars they built.

Take leasing for example. Manufacturers have to subsidize leases to help sell cars. This costs a lot of $$. Costs at the front end and back end.

If the transaction prices go up it means the used car prices go up. Big help with lease end residuals. The real cost of leasing for a manufacturer is the loss they take on residual values.

The really dirty secret is that the people who pay the highest lease payment prices are the best customers. They have the most loyalty to the brand and are far more likely to lease another with the brand.

This also helps the manufacturer because it's far more costly to go out and get new customers than it is to retain your existing.

So Daimlers plan is to leverage these customers and create more value by expanding the sub brands. The lesser cars like the A Class will fade away.

C Class transaction prices will go up. Both invoice and retail. Higher invoice prices means more profit for Daimler.

Daimler is working to cut costs, which will also boost profitability.

I believe there is a real sea change coming. Greater emphasis will be put on front end profits for the dealer and manufacturer. Electric cars won't generate the parts and service profitability of ICE cars.

So Daimler is moving their business model to compensate.

I keep bringing up GM because they were the biggest carmaker in the world and went bankrupt. Why? Because they had to spend so much money trying to move the too many cars they built.

Take leasing for example. Manufacturers have to subsidize leases to help sell cars. This costs a lot of $$. Costs at the front end and back end.

If the transaction prices go up it means the used car prices go up. Big help with lease end residuals. The real cost of leasing for a manufacturer is the loss they take on residual values.

The really dirty secret is that the people who pay the highest lease payment prices are the best customers. They have the most loyalty to the brand and are far more likely to lease another with the brand.

This also helps the manufacturer because it's far more costly to go out and get new customers than it is to retain your existing.

So Daimlers plan is to leverage these customers and create more value by expanding the sub brands. The lesser cars like the A Class will fade away.

C Class transaction prices will go up. Both invoice and retail. Higher invoice prices means more profit for Daimler.

Daimler is working to cut costs, which will also boost profitability.

I believe there is a real sea change coming. Greater emphasis will be put on front end profits for the dealer and manufacturer. Electric cars won't generate the parts and service profitability of ICE cars.

So Daimler is moving their business model to compensate.

My son started with the Honda Accord and when he needed an SUV he got the Honda Pilot. This is what brand loyalty is all about. The Mercedes customer today who gets an A or C Class will be the customer tomorrow for the E Class, the GLC and GLE.. That is why neither the A nor the C will go away.

Residuals: You have been in the industry for over 30 years so you will remember back then, 15 to 20 years ago, that at lease end residuals were negotiable. They no longer are. Why not: because every lease company has "gap insurance" to bridge the gap, if any, between the residual and the market value. So residuals really do not hurt the financial arm of Mercedes.

GM: this is a terrible example: their mix was out of date, quality was poor, proliferation of models without distinction, too many dealerships, which all led to small to negligible mark ups. The only part of GM that was making money was their financial arm GMAC. Diamler AG is not GM of 2008. You are comparing apples to diamonds.

You talk as if there is an endless supply of people who are willing and able to pay $60,000 plus for a Mercedes. That is just not accurate.

As you well know, just look at Tesla, there are economies of scale in the automotive manufacturing business. Tesla only became cash flow positive when they reached a critical production number. Every car manufacturer is the same. Each unit produced reduces the overall cost of each unit and hence the profitability for the manufacturer. That is Economics 101. As to the dealer: the greater the supply the more the reduction from MSRP. None of this is in a vacuum: each manufacturer at each price points has competition. If both a Mercedes and a BMW have the same MSRP and BMW leases with a 60% residual and Mercedes with a 54% residual, making the payments of the equivalent Mercedes $125 more per month, I think we can all surmise what will happen. Similarly if BMW discounts their cars 8% off of MSRP and MB sells at MSRP, we can all figure out what will happen.

Unless the Mercedes product is so unique or they limit production like Ferrari (18 month wait) what you suggesting cannot and will not happen..

Mercedes currently produces close to or just over 2 million vehicles per year. It is not Ferrari or Lamborghini - where price, because of limited supply, can be set and maintained by the manufacturer.

But I think your missing this point: selling a limited number of cars at MSRP will help the dealer, but it will not help Mercedes: What you are suggesting will only work without a dealership, like Tesla where you are buying direct from the manufacturer.

Where I do agree with you is the conversion to EV's: these will require fewer workers to produce and once mainstream far less service and last longer. The EV will change the dealership system. Personally, I would not want to be a dealer going forward: Both Ford with their Mustang and Tesla are showing that buying a car online is not only feasible but preferred. Other than delivery, online buying makes a car dealership obsolete. Those salesmen will be dinosaurs just like Merrill Lynch and other old school for fee brokerage houses.

The following users liked this post:

haibieb (09-22-2021)

#27

MBWorld Fanatic!

Join Date: Apr 2019

Location: Scottsdale AZ

Posts: 1,564

Received 448 Likes

on

357 Posts

2015 CLS 550 2015 ML 400 Previous 2020 GLB 250 2019 A 220 2005 ML 350 1989 300 E 2001 SL 500

Here are some of the points where I disagree::

My son started with the Honda Accord and when he needed an SUV he got the Honda Pilot. This is what brand loyalty is all about. The Mercedes customer today who gets an A or C Class will be the customer tomorrow for the E Class, the GLC and GLE.. That is why neither the A nor the C will go away.

Residuals: You have been in the industry for over 30 years so you will remember back then, 15 to 20 years ago, that at lease end residuals were negotiable. They no longer are. Why not: because every lease company has "gap insurance" to bridge the gap, if any, between the residual and the market value. So residuals really do not hurt the financial arm of Mercedes.

GM: this is a terrible example: their mix was out of date, quality was poor, proliferation of models without distinction, too many dealerships, which all led to small to negligible mark ups. The only part of GM that was making money was their financial arm GMAC. Diamler AG is not GM of 2008. You are comparing apples to diamonds.

You talk as if there is an endless supply of people who are willing and able to pay $60,000 plus for a Mercedes. That is just not accurate.

As you well know, just look at Tesla, there are economies of scale in the automotive manufacturing business. Tesla only became cash flow positive when they reached a critical production number. Every car manufacturer is the same. Each unit produced reduces the overall cost of each unit and hence the profitability for the manufacturer. That is Economics 101. As to the dealer: the greater the supply the more the reduction from MSRP. None of this is in a vacuum: each manufacturer at each price points has competition. If both a Mercedes and a BMW have the same MSRP and BMW leases with a 60% residual and Mercedes with a 54% residual, making the payments of the equivalent Mercedes $125 more per month, I think we can all surmise what will happen. Similarly if BMW discounts their cars 8% off of MSRP and MB sells at MSRP, we can all figure out what will happen.

Unless the Mercedes product is so unique or they limit production like Ferrari (18 month wait) what you suggesting cannot and will not happen..

Mercedes currently produces close to or just over 2 million vehicles per year. It is not Ferrari or Lamborghini - where price, because of limited supply, can be set and maintained by the manufacturer.

But I think your missing this point: selling a limited number of cars at MSRP will help the dealer, but it will not help Mercedes: What you are suggesting will only work without a dealership, like Tesla where you are buying direct from the manufacturer.

Where I do agree with you is the conversion to EV's: these will require fewer workers to produce and once mainstream far less service and last longer. The EV will change the dealership system. Personally, I would not want to be a dealer going forward: Both Ford with their Mustang and Tesla are showing that buying a car online is not only feasible but preferred. Other than delivery, online buying makes a car dealership obsolete. Those salesmen will be dinosaurs just like Merrill Lynch and other old school for fee brokerage houses.

My son started with the Honda Accord and when he needed an SUV he got the Honda Pilot. This is what brand loyalty is all about. The Mercedes customer today who gets an A or C Class will be the customer tomorrow for the E Class, the GLC and GLE.. That is why neither the A nor the C will go away.

Residuals: You have been in the industry for over 30 years so you will remember back then, 15 to 20 years ago, that at lease end residuals were negotiable. They no longer are. Why not: because every lease company has "gap insurance" to bridge the gap, if any, between the residual and the market value. So residuals really do not hurt the financial arm of Mercedes.

GM: this is a terrible example: their mix was out of date, quality was poor, proliferation of models without distinction, too many dealerships, which all led to small to negligible mark ups. The only part of GM that was making money was their financial arm GMAC. Diamler AG is not GM of 2008. You are comparing apples to diamonds.

You talk as if there is an endless supply of people who are willing and able to pay $60,000 plus for a Mercedes. That is just not accurate.

As you well know, just look at Tesla, there are economies of scale in the automotive manufacturing business. Tesla only became cash flow positive when they reached a critical production number. Every car manufacturer is the same. Each unit produced reduces the overall cost of each unit and hence the profitability for the manufacturer. That is Economics 101. As to the dealer: the greater the supply the more the reduction from MSRP. None of this is in a vacuum: each manufacturer at each price points has competition. If both a Mercedes and a BMW have the same MSRP and BMW leases with a 60% residual and Mercedes with a 54% residual, making the payments of the equivalent Mercedes $125 more per month, I think we can all surmise what will happen. Similarly if BMW discounts their cars 8% off of MSRP and MB sells at MSRP, we can all figure out what will happen.

Unless the Mercedes product is so unique or they limit production like Ferrari (18 month wait) what you suggesting cannot and will not happen..

Mercedes currently produces close to or just over 2 million vehicles per year. It is not Ferrari or Lamborghini - where price, because of limited supply, can be set and maintained by the manufacturer.

But I think your missing this point: selling a limited number of cars at MSRP will help the dealer, but it will not help Mercedes: What you are suggesting will only work without a dealership, like Tesla where you are buying direct from the manufacturer.

Where I do agree with you is the conversion to EV's: these will require fewer workers to produce and once mainstream far less service and last longer. The EV will change the dealership system. Personally, I would not want to be a dealer going forward: Both Ford with their Mustang and Tesla are showing that buying a car online is not only feasible but preferred. Other than delivery, online buying makes a car dealership obsolete. Those salesmen will be dinosaurs just like Merrill Lynch and other old school for fee brokerage houses.

Case in point, the A Class. What we have experienced is that the A Class buyer or lessee is usually maxed out on that car. Do some of them move up? Sure. Most don't. Most will lease something else if the lease price is too high for them.

In sedans, The E Class is the starting point for your brand loyal Mercedes buyer. The GLE for the SUV buyer. Although GLC loyalty rates were trending up.

As for the competition, BMW and Lexus cost less than Mercedes, always have. Do we lose people because they are cheaper? Sometimes. But we also have a lot of people who are willing to pay more for a Mercedes. This is our reality.

Again, you are free to perceive what you like. I'm just trying to give you the real picture.

FYI, the A 35 has already been dropped for 2022. Not a supplier issue the car was dropped before the supplier issues existed.

Here is Mercedes strategy going forward:https://www.daimler.com/company/stra...ric-drive.html

#28

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

UPDATE:

To anyone considering extending their lease, here is what I have been told today by Mercedes Remarketing:

As a courtesy Mercedes will extend your present lease for up to three months if you are actively looking for a replacement car and cannot find one. You will need to call Mercedes and confirm that you are actively looking.

At the end of three months, if you have not found a car and have decided to purchase a car and have a purchase order from a dealer, which the dealer will have to verify, Mercedes will extend your lease until the arrival of you new car.

If you decide not to order a new car at the end of three month extension, they you will either have to return your car or purchase it. FYI, Mercedes Remarketing provides financing for a purchase. I have also found that Bank of America provides financing for end of lease purchasing and of course other banks and/or credit unions may also provide for financing. The rate from Bank of America for end of lease purchasing is .5% higher than for a used car. Bank of America requires a "pay off" letter from Mercedes and they handle all the paper work and make the payment directly to Mercedes Financial. As a platinum preferred customer, BoA quoted me 2.89% for 44, 60 or 72 months.

Hope this clarifies.

To anyone considering extending their lease, here is what I have been told today by Mercedes Remarketing:

As a courtesy Mercedes will extend your present lease for up to three months if you are actively looking for a replacement car and cannot find one. You will need to call Mercedes and confirm that you are actively looking.

At the end of three months, if you have not found a car and have decided to purchase a car and have a purchase order from a dealer, which the dealer will have to verify, Mercedes will extend your lease until the arrival of you new car.

If you decide not to order a new car at the end of three month extension, they you will either have to return your car or purchase it. FYI, Mercedes Remarketing provides financing for a purchase. I have also found that Bank of America provides financing for end of lease purchasing and of course other banks and/or credit unions may also provide for financing. The rate from Bank of America for end of lease purchasing is .5% higher than for a used car. Bank of America requires a "pay off" letter from Mercedes and they handle all the paper work and make the payment directly to Mercedes Financial. As a platinum preferred customer, BoA quoted me 2.89% for 44, 60 or 72 months.

Hope this clarifies.

#29

Senior Member

Join Date: Jul 2018

Location: Jupiter, Fl

Posts: 464

Received 90 Likes

on

78 Posts

2022 GLE 450 (Black on Black)

We just extended our lease for another 3 months last week as stated above. We received the three payment coupons (and an additional 1,000 miles per month) on Monday. They did required a PO number for the car/SUV that you have on order. The call lasted about 10 minutes. Hopefully, our new GLE450 will come in early November since we have a built date of October 27th.

#30

Junior Member

Just locked in my build for a 2022 E450 All Terrain. Not a crazy build and MSRP is $77,180. For a 3 year lease, 10k miles/year, $0 down, MB wants $1,619/month. Residual is $42,449. Per my sales rep, MB is offering no discounts and no incentives on the All Terrain. Might just buy instead.

#31

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Just locked in my build for a 2022 E450 All Terrain. Not a crazy build and MSRP is $77,180. For a 3 year lease, 10k miles/year, $0 down, MB wants $1,619/month. Residual is $42,449. Per my sales rep, MB is offering no discounts and no incentives on the All Terrain. Might just buy instead.

By comparison, my 2019 E450, MSRP of $71,095, 3 years 10K miles per year, including NY State sales tax, with zero down is $897. If you back out the sales tax that comes to about $815 per month - almost exactly half what you are being quoted.

Clearly this is not the time to buy and/or lease a Mercedes. If you can wait, that would seem to be the prudent thing to do.

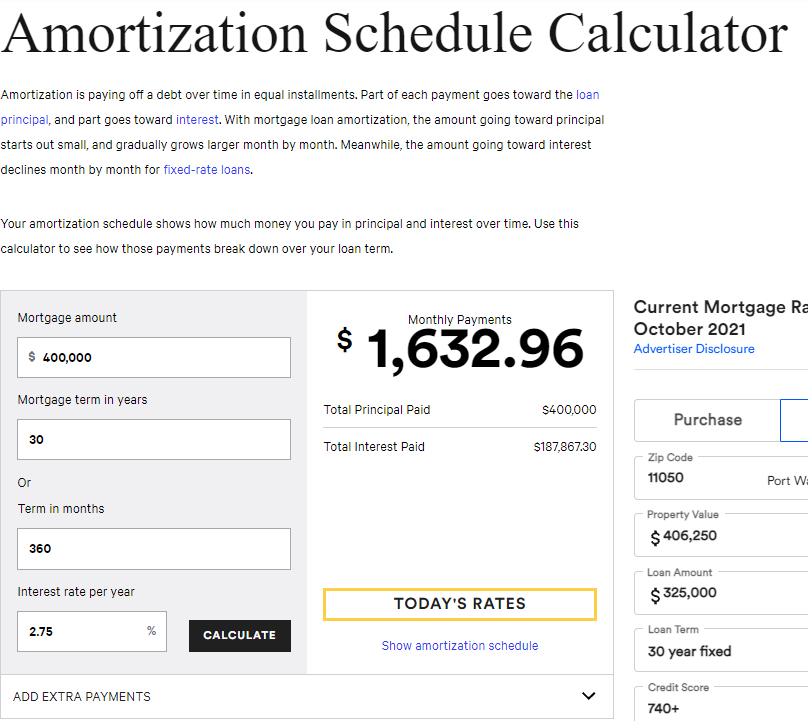

For "kicks" I found that a 30 year $400,000 @2.75% will cost about the same monthly payment as the 2022 All Terrain:

Last edited by JTK44; 10-15-2021 at 09:43 PM.

#32

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Just locked in my build for a 2022 E450 All Terrain. Not a crazy build and MSRP is $77,180. For a 3 year lease, 10k miles/year, $0 down, MB wants $1,619/month. Residual is $42,449. Per my sales rep, MB is offering no discounts and no incentives on the All Terrain. Might just buy instead.

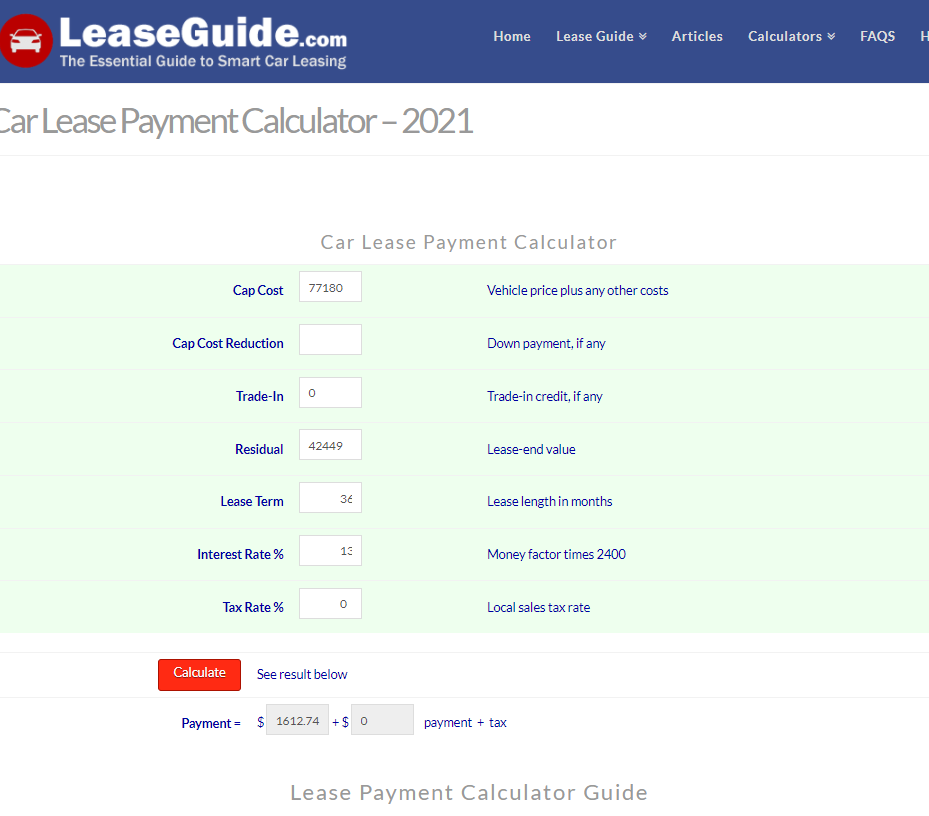

I believe something is really off: From the lease calculator below, that payment, with a cap cost of $77,180, residual of $42,449 means that the dealer is calculating interest at 13%.

You may want to discuss this with your dealer:

The following users liked this post:

BoMB (10-19-2021)

#33

MBWorld Fanatic!

Just locked in my build for a 2022 E450 All Terrain. Not a crazy build and MSRP is $77,180. For a 3 year lease, 10k miles/year, $0 down, MB wants $1,619/month. Residual is $42,449. Per my sales rep, MB is offering no discounts and no incentives on the All Terrain. Might just buy instead.

The following users liked this post:

BoMB (10-19-2021)

The following users liked this post:

BoMB (10-19-2021)

#35

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

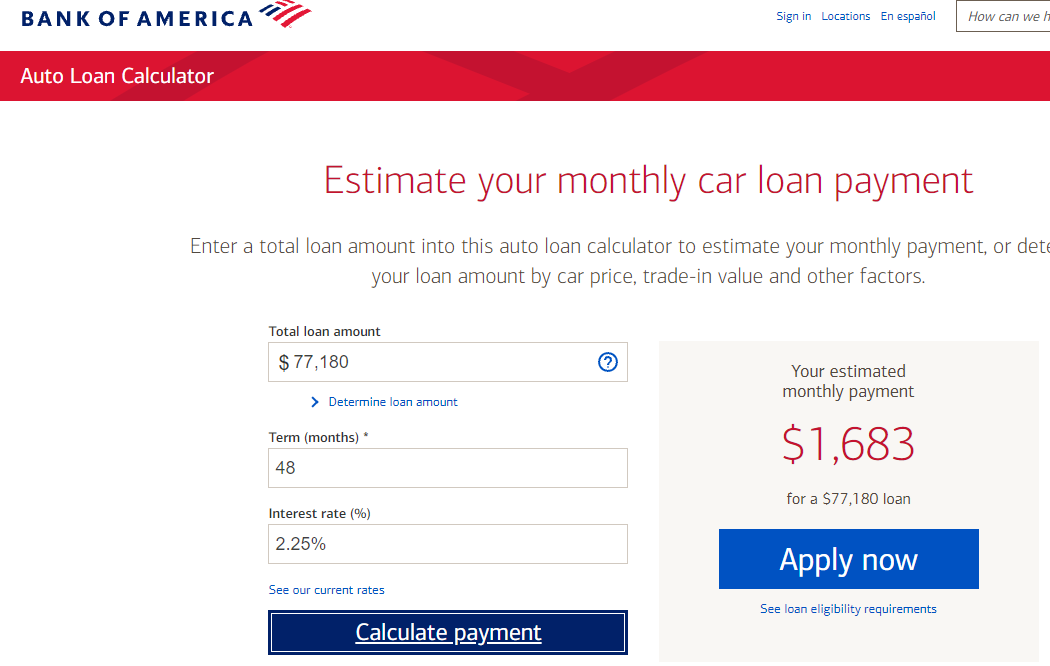

Loan at 2.25% for 48 months is pretty much what your dealer is quoting you for a 36 month lease. As the warranty is for 48 months, a 48 month loan makes sense;

The following users liked this post:

BoMB (10-19-2021)

#36

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

In New York the sales tax is not on the selling price, $77,180 but on the total of the 36 months payment - which is substantially less and one of the reasons to lease - the substantial savings on sales tax.

The leasing fee is $895. Add that to the selling price of $77,180 and your cost is $78,075. If we assume interest at 4% and sales tax at 8.5% your monthly payment is: $1,291. That is a difference $328 per month, $11,800 over the term of the lease.

The following users liked this post:

BoMB (10-19-2021)

#37

Junior Member

Appreciate the collective wisdom of this board and my first reaction was also that the dealer was adding a markup. But they are not budging on the lease terms so thatís why Iím considering buying instead. My other option is to buy out the lease on my 2019 E450 wagon, which actually expired last month and Iím extending month to month with MB until my 2022 is delivered.

#38

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Appreciate the collective wisdom of this board and my first reaction was also that the dealer was adding a markup. But they are not budging on the lease terms so that’s why I’m considering buying instead. My other option is to buy out the lease on my 2019 E450 wagon, which actually expired last month and I’m extending month to month with MB until my 2022 is delivered.

If they refuse, try another dealer.

You now have the link to the lease guide. Put your numbers in: either they are adding substantial dealer markup or substantial mark up on the money factor, i.e. the interest rate.

It is not possible to come to over $1600 a month on a $77,000 car without one or the other.

If this is happening I would walk from the dealer. They cannot be trusted.

The following users liked this post:

BoMB (10-19-2021)

#39

MBWorld Fanatic!

I would ask the dealer to give you in writing how they come to the $1619 a month lease payment.

If they refuse, try another dealer.

You now have the link to the lease guide. Put your numbers in: either they are adding substantial dealer markup or substantial mark up on the money factor, i.e. the interest rate.

It is not possible to come to over $1600 a month on a $77,000 car without one or the other.

If this is happening I would walk from the dealer. They cannot be trusted.

If they refuse, try another dealer.

You now have the link to the lease guide. Put your numbers in: either they are adding substantial dealer markup or substantial mark up on the money factor, i.e. the interest rate.

It is not possible to come to over $1600 a month on a $77,000 car without one or the other.

If this is happening I would walk from the dealer. They cannot be trusted.

Last edited by Elvisfan0108; 10-16-2021 at 12:47 AM.

The following users liked this post:

BoMB (10-19-2021)

#40

MBWorld Fanatic!

[QUOTE=Druid1;8437354]Should clarify the $1619/month includes NY sales tax and all dealer fees. Total cap cost is $85,988. But agree it is still very high.[/]

What are the sales tax and dealer fees?

What are the sales tax and dealer fees?

The following users liked this post:

BoMB (10-19-2021)

#41

Junior Member

Here's the breakdown:

Price -- 77,180

Taxable Fees -- 698

Dealer Conveyance Fee -- 895

Tax -- 5,171

Non Tax Fees -- 2,044

Total -- 85,988

The tax can't be correct. Also have not asked for details on the Non Tax Fees yet.

Price -- 77,180

Taxable Fees -- 698

Dealer Conveyance Fee -- 895

Tax -- 5,171

Non Tax Fees -- 2,044

Total -- 85,988

The tax can't be correct. Also have not asked for details on the Non Tax Fees yet.

The following users liked this post:

BoMB (10-19-2021)

#42

Member

If it was me I would absolutely buy the 2019 E450 and be very happy. Bank of America offers loan products for lease-end buyouts at very reasonable rates if a lump payment is not to your liking.

#43

MBWorld Fanatic!

$3,600 in fees seems high. I don't know how taxes work in NYC, especially on leases. But if it’s on payments, it sounds like around 10%. Non tax fees sounds like profit to me.

The following users liked this post:

BoMB (10-19-2021)

#44

Senior Member

UPDATE:

To anyone considering extending their lease, here is what I have been told today by Mercedes Remarketing:

As a courtesy Mercedes will extend your present lease for up to three months if you are actively looking for a replacement car and cannot find one. You will need to call Mercedes and confirm that you are actively looking.

At the end of three months, if you have not found a car and have decided to purchase a car and have a purchase order from a dealer, which the dealer will have to verify, Mercedes will extend your lease until the arrival of you new car.

If you decide not to order a new car at the end of three month extension, they you will either have to return your car or purchase it. FYI, Mercedes Remarketing provides financing for a purchase. I have also found that Bank of America provides financing for end of lease purchasing and of course other banks and/or credit unions may also provide for financing. The rate from Bank of America for end of lease purchasing is .5% higher than for a used car. Bank of America requires a "pay off" letter from Mercedes and they handle all the paper work and make the payment directly to Mercedes Financial. As a platinum preferred customer, BoA quoted me 2.89% for 44, 60 or 72 months.

Hope this clarifies.

To anyone considering extending their lease, here is what I have been told today by Mercedes Remarketing:

As a courtesy Mercedes will extend your present lease for up to three months if you are actively looking for a replacement car and cannot find one. You will need to call Mercedes and confirm that you are actively looking.

At the end of three months, if you have not found a car and have decided to purchase a car and have a purchase order from a dealer, which the dealer will have to verify, Mercedes will extend your lease until the arrival of you new car.

If you decide not to order a new car at the end of three month extension, they you will either have to return your car or purchase it. FYI, Mercedes Remarketing provides financing for a purchase. I have also found that Bank of America provides financing for end of lease purchasing and of course other banks and/or credit unions may also provide for financing. The rate from Bank of America for end of lease purchasing is .5% higher than for a used car. Bank of America requires a "pay off" letter from Mercedes and they handle all the paper work and make the payment directly to Mercedes Financial. As a platinum preferred customer, BoA quoted me 2.89% for 44, 60 or 72 months.

Hope this clarifies.

I was going to call the dealer as they keep emailing about buying a new car from them (and also got the useless "First Class Finish" brochure from MBFS in the mail last week - the number I called what they listed for Lease buyout options.)

Did you get this info from your dealer - or somehow did you speak to live person and MBFS that a brain and information?

Thanks!

#45

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

If you buy the tax is in on the purchase price: For example on a $75,000 car @8.5% (I believe this is the tax rate in NYC) the tax would be $6,375.

If you lease, the tax is on the sum of the lease payments: For example assume the sales price is $75,000, the residual is 55%, $41,250, 36 months and the interest rate (money factor) is 4%. The monthly payment would be.$1131. The total of the payments would be $40,716 (36 X 1131). The tax @ 8.5% would be $3,461.

In New York by leasing the tax savings would be $2,941.

Other states may treat taxes on leases differently but this is how it is done in New York.

The tax savings is one of the reasons, but not the only one, that over 80% of Mercedes in New York are leased.

Hope this clarifies.

#46

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Thanks JTK, this helps. I have a Cadilac CT4 Blackwing on order and called MBFS yesterday with questions about buyout/extensions because it wont be here by January when my lease is up. When I got thru the maze of voice prompts and I finally spoke to someone, they were just barely conscious. Everything was "I dont know" or "I dont have that information" Forget a Lease Extension - she did not even know what that was...Pen Fed CU is offering 2.39%/2.49% so I asked if they offer financing and what the rates were - no go, she did not know. I asked for a a payoff letter so I can buy out the car - ooops, that was a bridge too far for her brain, no info there either.

I was going to call the dealer as they keep emailing about buying a new car from them (and also got the useless "First Class Finish" brochure from MBFS in the mail last week - the number I called what they listed for Lease buyout options.)

Did you get this info from your dealer - or somehow did you speak to live person and MBFS that a brain and information?

Thanks!

I was going to call the dealer as they keep emailing about buying a new car from them (and also got the useless "First Class Finish" brochure from MBFS in the mail last week - the number I called what they listed for Lease buyout options.)

Did you get this info from your dealer - or somehow did you speak to live person and MBFS that a brain and information?

Thanks!

Suggest on Monday you try again and hopefully the person they connect you to will be able to give you answers.

BTW, to get my lease extension, I had to say "I was looking for a new Mercedes but the dealers have no E450 available for sale".

Good luck!

The following users liked this post:

Frank Rizzo (10-17-2021)

#47

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

I went to BoA, and they said they have a special program for lease end buyouts. All they need is the payoff letter from Mercedes Financial. They will do all the paper work. Their rates are good, but not great. I believe I was quoted 1/2 percent more than if I was buying a used car and 1% more if it was a new car.

Mercedes Financial will also finance the buyout, but their rates were higher than BoA.

Rates change every 30 days so it does pay to shop around.

I was given choice of 36, 44 and 60 months from BoA.

Hope this helps.

#48

MBWorld Fanatic!

Thread Starter

Join Date: May 2018

Location: Long Island, NY

Posts: 2,067

Received 589 Likes

on

447 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Taxable fees $698: sounds like dealer profit to me

Tax $5,171: I have no idea how this number is arrived at. You should ask the dealer how he arrived at this number

Non tax fees $2,044: like taxable fees this sounds like dealer profit.

You should also find out the money factor (interest) on the lease. The money factor is fixed by MB Financial, but the dealers can increase the money factor which is extra profit to them.

All in all, sounds like a terrible deal to me.

The following users liked this post:

BoMB (10-19-2021)

#49

MBWorld Fanatic!

In Florida, the dealers add a fee. The disclaimer states that it is processing and dealer profit. Apparently there is no such disclaimer in NY.

The following users liked this post:

BoMB (10-19-2021)

#50

Member

Another price point to consider. Not sure if I am going to do this or just buy out my current GLC when the lease is up.

2022 E350

$62,150 build price (black, panorama roof, heated steering wheel, premium pkg)

-$1,000 United Airlines Mileage Plus discount

$2,100 40k mile service plan

$1,095 taxable fees

$175 doc fee

$2,871.02 tax

$220 non-tax fees

-----------

$67,521.02

$4,000 out-the-door

36 months

15,000 miles/yr

$997/mo

Thoughts?

Thanks, John

2022 E350

$62,150 build price (black, panorama roof, heated steering wheel, premium pkg)

-$1,000 United Airlines Mileage Plus discount

$2,100 40k mile service plan

$1,095 taxable fees

$175 doc fee

$2,871.02 tax

$220 non-tax fees

-----------

$67,521.02

$4,000 out-the-door

36 months

15,000 miles/yr

$997/mo

Thoughts?

Thanks, John