Tips for leasing a GL450

#1

Junior Member

Thread Starter

Hi everyone:

My plan was to wait for the 2017 GLS refresh to arrive. Unfortunately, I think we will need to expedite our timeframe for our GL. The dealer suggested a two year lease. I have NEVER leased before and I don't even know where to start. Any tips? Do you negotiate a price first and then work from there? Please help out a naive leasing newbie and if there is a thread already dedicated to this please feel free to point me in the right direction.

Thanks!

My plan was to wait for the 2017 GLS refresh to arrive. Unfortunately, I think we will need to expedite our timeframe for our GL. The dealer suggested a two year lease. I have NEVER leased before and I don't even know where to start. Any tips? Do you negotiate a price first and then work from there? Please help out a naive leasing newbie and if there is a thread already dedicated to this please feel free to point me in the right direction.

Thanks!

#2

There are some threads if you search. Just on the fly:

- 24 months is not that attractive for MB

- yes you can negotiate the sales price first, then tell them you want to lease. The sales price is just as important.

- Residual percentage (which is applied against the MSRP) is fixed by MB so they can't screw you on that

- Money Factor (MF) - they will screw you on this. You can check edmunds - search edmunds gl450 lease and go on that forum to see what the MF should be. Make sure you get the buy rate.

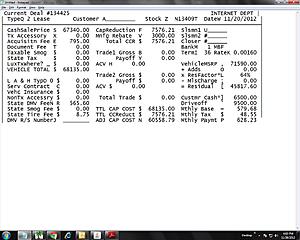

- Fees - have the dealer email you a screenshot of the lease so you can see what other fees they put in there.

- Down payment - never do this

- Mileage - I always go for the minimum but you can do the math to see what is cheaper

Check out this website - http://www.ridewithg.com/2008/07/gs-...-auto-leasing/

It walks you through it and has a calculator that is helpful.

Basically, you are introducing other variables with leasing. But if you can understand them and control that you will be okay.

If you absolutely have to make a move on a car - maybe get a used one for a while.

- 24 months is not that attractive for MB

- yes you can negotiate the sales price first, then tell them you want to lease. The sales price is just as important.

- Residual percentage (which is applied against the MSRP) is fixed by MB so they can't screw you on that

- Money Factor (MF) - they will screw you on this. You can check edmunds - search edmunds gl450 lease and go on that forum to see what the MF should be. Make sure you get the buy rate.

- Fees - have the dealer email you a screenshot of the lease so you can see what other fees they put in there.

- Down payment - never do this

- Mileage - I always go for the minimum but you can do the math to see what is cheaper

Check out this website - http://www.ridewithg.com/2008/07/gs-...-auto-leasing/

It walks you through it and has a calculator that is helpful.

Basically, you are introducing other variables with leasing. But if you can understand them and control that you will be okay.

If you absolutely have to make a move on a car - maybe get a used one for a while.

#3

MBWorld Fanatic!

I am sure other members will chime in - the key elements of the lease are (1) Annual miles (2) Cash into front end of transaction and (3) Monthly payment incl taxes/fee's

Before I break that out - let me say two things :

1) On your next Mercedes - on GL's Mercedes down-the-road often will offer "Loyalty Accelerator" - where MB Financial as a smart customer retention incentive will offer to pay/wipe-out the last 3-6 months lease payment - if you move forward to the next qualifying Mercedes - so a 24 month lease can be 21 months actual, or as low as 18 mo actual, using the Loyalty Accelerator to leverage into the next Mercedes

2) On a lease - if your dealer finance guy knows their stuff - add on programs like prepaid maintenance, wheel/tire, etc can be added as "cap items" meaning your tur out-of-pocket cost for those are based on the same depreciation % as the vehilce - so instad of "paying" $1000 for example - your cost will be $650 for example - so for leases things like prepaid maintenance and other "stuff" can be a downright bargain.

The common "lease terms" that make up payment : residual percentage (example a 65% lease residual means you will pay/finance 35% of the vehicles MSRP, residual value at lease end, and "money factor" which is interest, and fee's..

When a MB dealer, or customer, starts sharpshooting on those factors - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? and what are my payments ? how are taxes and fee's handled ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease expert.

Keep the beat !

Before I break that out - let me say two things :

1) On your next Mercedes - on GL's Mercedes down-the-road often will offer "Loyalty Accelerator" - where MB Financial as a smart customer retention incentive will offer to pay/wipe-out the last 3-6 months lease payment - if you move forward to the next qualifying Mercedes - so a 24 month lease can be 21 months actual, or as low as 18 mo actual, using the Loyalty Accelerator to leverage into the next Mercedes

2) On a lease - if your dealer finance guy knows their stuff - add on programs like prepaid maintenance, wheel/tire, etc can be added as "cap items" meaning your tur out-of-pocket cost for those are based on the same depreciation % as the vehilce - so instad of "paying" $1000 for example - your cost will be $650 for example - so for leases things like prepaid maintenance and other "stuff" can be a downright bargain.

The common "lease terms" that make up payment : residual percentage (example a 65% lease residual means you will pay/finance 35% of the vehicles MSRP, residual value at lease end, and "money factor" which is interest, and fee's..

When a MB dealer, or customer, starts sharpshooting on those factors - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? and what are my payments ? how are taxes and fee's handled ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease expert.

Keep the beat !

#5

When a MB dealer, or customer, starts sharpshooting on those factors - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? and what are my payments ? how are taxes and fee's handled ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease expert.

Keep the beat !

Keep the beat !

A) Out of pocket - if you are leasing it really should be the minimum possible (ie no down payment), particularly if you may do a lease pull in as you are just giving that cash up. Or worse if the car gets wrecked.

B) Miles - just about every MB lease scenario I have run tells me it is cheaper to go with the least miles possible and just pay mileage overage at the end. Compound this with a possible lease pull in or dealers may waive an overage to get you into another lease. Plus, why pay more miles you may not even use? It's just math.

C) Taxes - forgot this before, in some state such as CA, you only pay the amount of sales tax on the lease that month instead of the whole amount upfront. Big savings, but some states are different.

D) Fees - make sure you get that screen shot so you can double check for any fees. Some of them are standard, some are just pure profit to the dealer

E) Interest rate - do realize that the MF or interest rate you are paying is higher than if you were to take out a loan to purchase.

I may be skeptical, but I view leasing as just another place a dealer makes profit, so just as you would research invoice pricing etc when buying a car, educate yourself and research just as much on the leasing front.

Focusing on just the monthly payment is a recipe for disaster - why do you think the dealers want you to just focus on that?

#6

Super Member

Mercedes is a PIA with going over the mileage on a lease. They don't allow you to buy additional miles before contract due date.

BMW and Audi both do, at a discounted rate. You pay the .20/.25 per your contract at lease end with MBUSA, no discounts.

BMW and Audi both do, at a discounted rate. You pay the .20/.25 per your contract at lease end with MBUSA, no discounts.

Last edited by Mike450; 06-23-2015 at 10:46 AM.

#7

As the residuals change with the amount of mileage (ie lower residual with more miles which equals a higher monthly lease payment) - I would ask for a quote at the miminal miles, say 7,500 miles and also at 10,000 miles on a 36 month lease.

Then just do the math.

If it cost $0.30 / mile overage, then if you did the 7,500 mile lease and went over by 2,500 miles this may cost you $750 at the end of the lease.

Compare this to the 10,000 mile lease payment and if it the difference between the lease payments is $21/month or less (36 months x $21 = $750) - why wouldn't you go with the 7,500 mile lease?

Plus the chance you will never use the miles.

Then just do the math.

If it cost $0.30 / mile overage, then if you did the 7,500 mile lease and went over by 2,500 miles this may cost you $750 at the end of the lease.

Compare this to the 10,000 mile lease payment and if it the difference between the lease payments is $21/month or less (36 months x $21 = $750) - why wouldn't you go with the 7,500 mile lease?

Plus the chance you will never use the miles.

Trending Topics

#8

Junior Member

Thread Starter

Thanks for the valuable tips

Thanks everyone for the great tips!

I have encountered a few things that make me think that I need to know all my details before going into the dealership or else I'm going to get swindled

-I have requested twice the a screen shot of the lease contract and it seems to just get ignored.

- he has given me a monthly lease payment amount ($600) despite the fact that we haven't even talked yearly mileage.

I'll let you know how it goes!

Thanks again.

I have encountered a few things that make me think that I need to know all my details before going into the dealership or else I'm going to get swindled

-I have requested twice the a screen shot of the lease contract and it seems to just get ignored.

- he has given me a monthly lease payment amount ($600) despite the fact that we haven't even talked yearly mileage.

I'll let you know how it goes!

Thanks again.

#9

Member

Join Date: Aug 2013

Location: Southeast

Posts: 94

Likes: 0

Received 1 Like

on

1 Post

2016 GL450; 2015 C300 Sport

As the residuals change with the amount of mileage (ie lower residual with more miles which equals a higher monthly lease payment) - I would ask for a quote at the miminal miles, say 7,500 miles and also at 10,000 miles on a 36 month lease.

Then just do the math.

If it cost $0.30 / mile overage, then if you did the 7,500 mile lease and went over by 2,500 miles this may cost you $750 at the end of the lease.

Compare this to the 10,000 mile lease payment and if it the difference between the lease payments is $21/month or less (36 months x $21 = $750) - why wouldn't you go with the 7,500 mile lease?

Plus the chance you will never use the miles.

Then just do the math.

If it cost $0.30 / mile overage, then if you did the 7,500 mile lease and went over by 2,500 miles this may cost you $750 at the end of the lease.

Compare this to the 10,000 mile lease payment and if it the difference between the lease payments is $21/month or less (36 months x $21 = $750) - why wouldn't you go with the 7,500 mile lease?

Plus the chance you will never use the miles.

Thanks everyone for the great tips!

I have encountered a few things that make me think that I need to know all my details before going into the dealership or else I'm going to get swindled

-I have requested twice the a screen shot of the lease contract and it seems to just get ignored.

- he has given me a monthly lease payment amount ($600) despite the fact that we haven't even talked yearly mileage.

I'll let you know how it goes!

Thanks again.

I have encountered a few things that make me think that I need to know all my details before going into the dealership or else I'm going to get swindled

-I have requested twice the a screen shot of the lease contract and it seems to just get ignored.

- he has given me a monthly lease payment amount ($600) despite the fact that we haven't even talked yearly mileage.

I'll let you know how it goes!

Thanks again.

I am also of the mindset that it is better to have higher monthly payments than to come out of pocket a chunk with down payment to drive note lower. you wreck the car and total it month 1, you're out a hefty bit...

best practice is to always do your research ahead of time. trust me, buyers that do their research not only can get solid deals, but the salespeople and managers can appreciate it, as well. it cuts down on a lot of the back and forth...

last thing: I would think it's common sense for most people, but IF you decide to shop two different dealers and you're looking at the same lease structure (ie. 36 months and 10k miles per year) and they are giving you different payments with the same amount of money down, make sure that you are comparing apples to apples (both have the same MSRP and they're not $4k apart in listed price) and that they are both factoring in fees/taxes. there's nothing worse than a customer saying 'oh, well MB of xxxxx told me $850/month and the same vehicle with you is $950/month.' the lower quote may not even be factoring in state fees, acquisition fee, taxes, etc.

#10

Member

Join Date: Aug 2013

Location: Southeast

Posts: 94

Likes: 0

Received 1 Like

on

1 Post

2016 GL450; 2015 C300 Sport

oh, and if you're being quoted $600/month on a GL, i'm guessing it's a stripped down model, quoted for 10k miles per year and hefty down payment...possibly without any taxes being factored in. MBUSA.com specials for leasing have the fine print, just like any other manufacturer. the payments are quoted based on a particular build with MSRP 'X', a set number of months/miles, a certain down payment, and taxes/MF not factored in yet...

#11

Super Member

The money factor from MBUSA finance is public knowledge. They are not upfront about the factor sometimes because they mark it up from that. While they are surely in the business to make money, if you ask for the MF and they BS you, thats starting out on the wrong foot. If you ask for the MF, they should have zero issue providing it to you. Who would finance a purchase without knowing the interest rate? No one would.

A lease is rather simple math. There is no magic formula. If you know the cap cost, the residual, the MF and the term, you can figure any base payment to the penny.

How much the dealer is making off the deal from a holdback/rebate/program $ is a completely different discussion. If you know those terms above and shop them across 2-3 dealers, you'll have an idea what kind of deal you are getting.

And yes, $600/month on any in stock GL is probably with $10k OOP.

A lease is rather simple math. There is no magic formula. If you know the cap cost, the residual, the MF and the term, you can figure any base payment to the penny.

How much the dealer is making off the deal from a holdback/rebate/program $ is a completely different discussion. If you know those terms above and shop them across 2-3 dealers, you'll have an idea what kind of deal you are getting.

And yes, $600/month on any in stock GL is probably with $10k OOP.

Last edited by Mike450; 06-24-2015 at 05:35 PM.

#12

Member

Join Date: Aug 2013

Location: Southeast

Posts: 94

Likes: 0

Received 1 Like

on

1 Post

2016 GL450; 2015 C300 Sport

The money factor from MBUSA finance is public knowledge. They are not upfront about the factor sometimes because they mark it up from that. While they are surely in the business to make money, if you ask for the MF and they BS you, thats starting out on the wrong foot.

A lease is rather simple math. There is no magic formula. If you know the cap cost, the residual, the MF and the term, you can figure any base payment to the penny.

A lease is rather simple math. There is no magic formula. If you know the cap cost, the residual, the MF and the term, you can figure any base payment to the penny.

i agree that if you get BS'ed about the MF when asking that the dealer is starting on the wrong foot. however, sometimes people will ask about them and have no clue what it is, what the standard rate is, how it factors into their lease, or otherwise. it is my opinion that buyers want a good deal, dealers need to make money, etc. you wouldn't go into the supermarket and negotiate the price on a gallon of milk, but it's expected in the car business. not saying that it's right or wrong; just saying that it's life...i actually found out some years back that you can negotiate the price on tv's, appliances, etc if you know how to do it right...

#13

Super Member

Edmunds gets their info from a number of sources, mostly dealerships and simple back math from the MBUSA website where they post their monthly lease deals.

So, is it specifically public posted info directly from MBUSA? No, but it's certainly very accurate info on edmunds and the like websites. Very accurate.

The ill informed car purchaser is whole other issue. While I personally despise the whole car buying negotiation process, it is a system the dealerships themselves created. They can't ***** about it when it frustrates them. It's the business model they wanted.

So, is it specifically public posted info directly from MBUSA? No, but it's certainly very accurate info on edmunds and the like websites. Very accurate.

The ill informed car purchaser is whole other issue. While I personally despise the whole car buying negotiation process, it is a system the dealerships themselves created. They can't ***** about it when it frustrates them. It's the business model they wanted.

Last edited by Mike450; 06-24-2015 at 05:56 PM.

#14

Member

Join Date: Aug 2013

Location: Southeast

Posts: 94

Likes: 0

Received 1 Like

on

1 Post

2016 GL450; 2015 C300 Sport

Edmunds gets their info from a number of sources, mostly dealerships and simple back math from the MBUSA website where they post their monthly lease deals.

So, is it specifically public posted info directly from MBUSA? No, but it's certainly very accurate info on edmunds and the like websites. Very accurate.

The ill informed car purchaser is whole other issue. While I personally despise the whole car buying negotiation process, it is a system the dealerships themselves created.

So, is it specifically public posted info directly from MBUSA? No, but it's certainly very accurate info on edmunds and the like websites. Very accurate.

The ill informed car purchaser is whole other issue. While I personally despise the whole car buying negotiation process, it is a system the dealerships themselves created.

as for the negotiation process, let's just say that it's sad when people ask you to give them your best offer and discount and you really give it to them, they want more. customers play the game and somewhat force the dealers to do the same. it's a never-ending cycle of someone trying to 'one-up' the other. i think that if people would just come to agree that something that can be fair for both parties, everything would be better...but i guess that would take the fun out of it. haha

#15

MBWorld Fanatic!

From a "buyer's perspective" - please be aware generating a lease proposal on the sales side for most dealer's is a bit more time/effort intensive than generating a purchase proposal - common business practice, yes, just letting you know the mechanics.

What helps the mechanics - frankly so you can focus on what is important helps in the process is a understanding from the buyer's side - (1) the specific rig (2) the mileage for the lease (3) term (4) your flexibility, or in-flexibility on your cash-in position for the contact, which has a direct impact on payments over the term

I have never seen "screen shots" as described earlier here -

The common "lease terms" that make up payment : residual percentage (example a 65% lease residual means you will pay/finance 35% of the vehicles MSRP, residual value at lease end, and "money factor" which is interest, and fee's..

When you sharpshoot on any specific factor - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? for how long ? how are sales taxes and state fee's handled in the lease ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease "expert" - take a smoother road.

The overall "smoothness" of leasing is to ease the process moving from one new vehicle down the road - nice to drive the right new MB every 2-3 yrs..

What helps the mechanics - frankly so you can focus on what is important helps in the process is a understanding from the buyer's side - (1) the specific rig (2) the mileage for the lease (3) term (4) your flexibility, or in-flexibility on your cash-in position for the contact, which has a direct impact on payments over the term

I have never seen "screen shots" as described earlier here -

The common "lease terms" that make up payment : residual percentage (example a 65% lease residual means you will pay/finance 35% of the vehicles MSRP, residual value at lease end, and "money factor" which is interest, and fee's..

When you sharpshoot on any specific factor - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? for how long ? how are sales taxes and state fee's handled in the lease ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease "expert" - take a smoother road.

The overall "smoothness" of leasing is to ease the process moving from one new vehicle down the road - nice to drive the right new MB every 2-3 yrs..

#16

I always let the dealer know they have one shot, ask 2-3 dealers for their best sales price and MF and let them know it's a one shot deal as both their time and mine is valuable. Best deal wins.

#17

#18

Super Member

From a "buyer's perspective" - please be aware generating a lease proposal on the sales side for most dealer's is a bit more time/effort intensive than generating a purchase proposal - common business practice, yes, just letting you know the mechanics.

What helps the mechanics - frankly so you can focus on what is important helps in the process is a understanding from the buyer's side - (1) the specific rig (2) the mileage for the lease (3) term (4) your flexibility, or in-flexibility on your cash-in position for the contact, which has a direct impact on payments over the term

I have never seen "screen shots" as described earlier here -

The common "lease terms" that make up payment : residual percentage (example a 65% lease residual means you will pay/finance 35% of the vehicles MSRP, residual value at lease end, and "money factor" which is interest, and fee's..

When you sharpshoot on any specific factor - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? for how long ? how are sales taxes and state fee's handled in the lease ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease "expert" - take a smoother road.

The overall "smoothness" of leasing is to ease the process moving from one new vehicle down the road - nice to drive the right new MB every 2-3 yrs..

What helps the mechanics - frankly so you can focus on what is important helps in the process is a understanding from the buyer's side - (1) the specific rig (2) the mileage for the lease (3) term (4) your flexibility, or in-flexibility on your cash-in position for the contact, which has a direct impact on payments over the term

I have never seen "screen shots" as described earlier here -

The common "lease terms" that make up payment : residual percentage (example a 65% lease residual means you will pay/finance 35% of the vehicles MSRP, residual value at lease end, and "money factor" which is interest, and fee's..

When you sharpshoot on any specific factor - it gets confusing to me - because bottom line - how much out of my pocket today ? how many miles do I plan to drive ? for how long ? how are sales taxes and state fee's handled in the lease ? - I propose it is best to focus on the end-result-cost - rather than becoming a lease "expert" - take a smoother road.

The overall "smoothness" of leasing is to ease the process moving from one new vehicle down the road - nice to drive the right new MB every 2-3 yrs..

If I walk in and say I'm interested in a GL350, I can do $4K at signing and $900/mo, 8 out of 10 dealers will come back w/ a deal for $920-$930/mo. Even w/ base rates and some profit built in, if the numbers actually came in at $850, how many would present the customer w/ the $850 number? Most would make some kind of adjustment to take advantage of that extra $50/mo the customer left on the table.

I have found that by being lease savvy, you are doing yourself a favor. Once you can do the calculations on the fly, while sitting at your CA's desk, you can see for yourself how your payment changes when say looking at 1 vehicle w/ the pano roof vs another without it. You're also able to see and understand the difference if you were to pay the acq and registration fees out of pocket/at signing vs having them rolled into the lease and also now paying interest on those fees instead of only on the vehicle. With that said, the dealer does have to make money as well. So again, understanding each of the variables, allowing a slight markup on the MF in exchange for a lower selling price, throwing in the maintenance plan, or even the wheel & tire ins can still have you coming out ahead.

#19

Junior Member

Join Date: Jan 2013

Location: Utah

Posts: 50

Likes: 0

Received 0 Likes

on

0 Posts

2013 BMW 550ix

I will add that MB allows you to do MSD's (multiple security deposits). This is money you give them that lowers the MF. You get this money back when the lease is over. They will take up to 10 MSD's (you don't have to do all 10). Roughly speaking, 10 MSD's will cost about $10,000 (remember, you get this back at end of lease) and it will lower the MF enough to save you roughly $100/month. Translated, this is about a 10-12% return per year on your $10,000. So if you have $10,000 hanging around, doing this is a no brainer.

#20

Member

ridewithg.com is very informative. A vehicle with a higher residual (what the car is worth at lease end) will have smaller payments than if you have a low residual. You are only playing for the amount of car you are using for a given time (24, 30, 36 months etc). Each amount of lease time has a different residual so each vehicle has a "sweet spot" meaning better (lower) payments for maybe a 33 month lease than a 24 month lease or vice versa. You just have to ask what the residual is for each amount of time. MF can be converted to a percentage by multiplying by 2400. Example: MF of .0024 x 2400= 5.76. This gives you an idea what the lease is costing you. Dealers do indeed make money on the MF by marking it up so they get monthly payment kickbacks for every little bit above the base rate they mark it up. Finding what the base rate is can be the tricky part. Just do your homework as others have suggested. MB will waive the mileage overage if you go into a new MB early by terminating your lease early so if you think that's what you will do then pay for less miles up front. You can also pay your entire lease payments up front to save even more but why would you? It's a lease. You are trying to not put money up front and spread the outlay of cash out over time.

Good luck. Hope you get a great deal.

Good luck. Hope you get a great deal.