2021 E450 vs 2019 S560

#26

MBWorld Fanatic!

Join Date: Oct 2002

Location: Cincinnati

Posts: 4,292

Received 1,019 Likes

on

741 Posts

2010 E350 4Matic

I am somewhat confused by your post.

All cars, Mercedes included, have reduced the "relative cost of their cars", Given the cost of my first Mustang in 1966 $2,500 for a GT V8 289 engine the cost of a 2021 Mustang in constant dollars is less. This is true for all manufacturers

If Mercedes has "actually have pulled off a pretty good feat to produce cars as good as they are for the price that they sell them for" then I would expect the resale value of the Mercedes to have held up better but certainly equal to other cars, while in fact the opposite is true: As a class Mercedes (and Audi and BMW) do not hold their value relative to most cars.

We all know the horror stories of maintaining a Mercedes - one the reasons I lease and do not buy: But it wasn't always this way. When in the 70's and 80's, as compared to other cars, Mercedes were built to last, their resale value was outstanding.

I think several things have happened:

Just my $.02

All cars, Mercedes included, have reduced the "relative cost of their cars", Given the cost of my first Mustang in 1966 $2,500 for a GT V8 289 engine the cost of a 2021 Mustang in constant dollars is less. This is true for all manufacturers

If Mercedes has "actually have pulled off a pretty good feat to produce cars as good as they are for the price that they sell them for" then I would expect the resale value of the Mercedes to have held up better but certainly equal to other cars, while in fact the opposite is true: As a class Mercedes (and Audi and BMW) do not hold their value relative to most cars.

We all know the horror stories of maintaining a Mercedes - one the reasons I lease and do not buy: But it wasn't always this way. When in the 70's and 80's, as compared to other cars, Mercedes were built to last, their resale value was outstanding.

I think several things have happened:

- Mercedes in fact do not last longer than other cars;

- Mercedes might in fact be overly complicated and their are more parts that can fail: and

- Parts for Mercedes as compared to other cars are often two to three times as much (think about the "A" service, oil change and filter, $200)

Just my $.02

It comes down to the trade people are willing to make. One can go buy a Lexus which should be easier on the wallet but it doesn't drive the same.

Again don't get me wrong I would prefer that it was like to old days and Mercedes were still built to last forever. When I had my W211 it felt like the relationship with Mercedes was no longer here is a car that if you maintain it it will last forever but rather we have provided you with a means to establish an ongoing cash flow back to Mercedes.

I am always on the fence whether to throw in the towel and give up on the brand. A 60 year relationship is hard to break. I have a lot of nostalgia for the brand that the maintenance costs occasionally snap me out of.

And for me personally the steep deprecation is my friend as I don't buy new.

Which brings me back to the topic. I would pick the S Class over the E Class if it provided sufficient differentiation in terms of refinement and driving satisfaction if not then the E Class because of the reduced length. One thing for sure the S class is a better looking car.

Last edited by MBNUT1; 06-12-2021 at 05:28 PM.

The following users liked this post:

JTK44 (06-12-2021)

#27

MBWorld Fanatic!

My W211 E55 was supposed to be my forever car until I got that $8k five o'clock surprise for repairing the air suspension. I skipped the W212 because I did not like the styling and filled in with my BMW 5 Series. I bought the W213 E300, but I was immediately unhappy with its highway performance and relegated it to city only driving. Now MB has removed apps and capabilities that I used on a daily basis. I'll probably NOT consider another MB when the 2022 models become available. BMW? Bentley? Time will tell.

#28

MBWorld Fanatic!

Join Date: Apr 2019

Location: Scottsdale AZ

Posts: 1,564

Received 448 Likes

on

357 Posts

2015 CLS 550 2015 ML 400 Previous 2020 GLB 250 2019 A 220 2005 ML 350 1989 300 E 2001 SL 500

You are correct to point. Extra volume will cause depreciation.

Having said that, one would think that with extra opportunity cost of buying a Mercedes that the rate of depreciation would be less than on a car that cost 1/3 as much.

In fact it is the opposite: the rate of depreciation is more.

Here is another fact:

I am leasing a 2018 Ford Edge Sport that ends in September 2021. The residual is $25,254. Normally the lease is "upside down": The lessee has no equity in the car: the residual at lease end is almost always higher than the cars value. Last year at this time the car had a blue book value of about $28,000. Today the blue book value of the same car, but it is one year older is $35,000. I presently have about $10,000 of equity in the car.

The Ford, with a MSRP of $47,000 has gone up $7,000. That is a 15% increase in value.

The lease on my 2019 E450 ends in December 2021. The residual is $41,946. The present blue book value of my E450 is $45,000 - about what is was last year at this time.

My 2019 E450 with a MSRP of $71,000, unlike the Ford and most other cars, has not gone up in value over the past year.

If my Mercedes had performed as my Ford did, today it would be worth $55,500 - not $45,000 (an increase in value of 15%) and instead of having $4,000 in equity I would have about $14,000 in equity.

Having said that, one would think that with extra opportunity cost of buying a Mercedes that the rate of depreciation would be less than on a car that cost 1/3 as much.

In fact it is the opposite: the rate of depreciation is more.

Here is another fact:

I am leasing a 2018 Ford Edge Sport that ends in September 2021. The residual is $25,254. Normally the lease is "upside down": The lessee has no equity in the car: the residual at lease end is almost always higher than the cars value. Last year at this time the car had a blue book value of about $28,000. Today the blue book value of the same car, but it is one year older is $35,000. I presently have about $10,000 of equity in the car.

The Ford, with a MSRP of $47,000 has gone up $7,000. That is a 15% increase in value.

The lease on my 2019 E450 ends in December 2021. The residual is $41,946. The present blue book value of my E450 is $45,000 - about what is was last year at this time.

My 2019 E450 with a MSRP of $71,000, unlike the Ford and most other cars, has not gone up in value over the past year.

If my Mercedes had performed as my Ford did, today it would be worth $55,500 - not $45,000 (an increase in value of 15%) and instead of having $4,000 in equity I would have about $14,000 in equity.

Luxury cars depreciate at a higher rate than regular cars. One of the reasons is that someone who can afford a new E 450 isn't going to buy a used one if it's close in price to a new one. Most E 450's are leased, so the payment difference precludes someone for paying close to new price for a used one.

Right now, the market for used SUV's is insane. Any SUV is going to sell for more money right now. We've seen the prices shoot up on GLE and GLC's.

#29

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

My W211 E55 was supposed to be my forever car until I got that $8k five o'clock surprise for repairing the air suspension. I skipped the W212 because I did not like the styling and filled in with my BMW 5 Series. I bought the W213 E300, but I was immediately unhappy with its highway performance and relegated it to city only driving. Now MB has removed apps and capabilities that I used on a daily basis. I'll probably NOT consider another MB when the 2022 models become available. BMW? Bentley? Time will tell.

As to buying used: My father taught me when you buy used you are buying someone else's headache. There are enough postings on this forum that question the value of a CPO Mercedes which should be the "cream of the crop". So anything other than a CPO will in all likelihood be something less - problematic at best and a money pit at worst.

Fortunately I can afford almost any car I want and I am at an age that what I do not spend will only go to my kids. So for me when I lease a Mercedes I know it expensive but something I can afford and enjoy driving.

But it is certainly not an efficient use of my money and if I were younger I would probably not be doing it. If I were younger with expenses in front of me I would be far more practical. At my age all our expenses are behind us.

Just the musing of a person whose first car was a new 1966 Ford Mustang GT convertible who remembers the "good old days" when you paid more you got quality and durability and a car that held its value.

The following users liked this post:

Streamliner (06-13-2021)

#30

MBWorld Fanatic!

I understand your position on leasing, but that is something I will never do. My father taught me to never borrow money or enter into a contract such as leasing that is essentially a debt instrument. I've followed that advice my entire life. If I can't pay for something up front, I can't afford it.

#31

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

I understand your position on leasing, but that is something I will never do. My father taught me to never borrow money or enter into a contract such as leasing that is essentially a debt instrument. I've followed that advice my entire life. If I can't pay for something up front, I can't afford it.

For many, many years my father resisted leasing, despite all the potential advantages from a tax point of view. Our offices were in Manhattan and of course we rented our offices. I asked my father would we ever own our offices and he said of course not. It was an "ah ah" moment for him. He then understood leasing a car vs. owning.

The following users liked this post:

CarFan1 (06-13-2021)

#33

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Dividends: My understanding is that dividends are not tax free but are a tax preference.

Whether a retired person benefits tax wise from leasing vs. buying, probably not, is not the point. Once you have accepted that leasing is no more going into debt than renting an office vs. buying the office, than if you intend to keep the car for only the duration of the warranty as I do, then leasing is far more efficient use of your money than buying.

If you check with your accountant or if you do your own financial planning, once you factor in use of money or opportunity costs of money, buying and selling a car when the warranty is over vs. leasing a car for the warranty period, leasing will always be more efficient. Buying is only cheaper if you keep the car for beyond 6 years. Anything less than 6 years, leasing will always be more efficient use of your money.

Last edited by JTK44; 06-13-2021 at 09:23 AM.

#34

Out Of Control!!

Join Date: Sep 2018

Location: unbegrenzt

Posts: 13,407

Received 3,967 Likes

on

3,119 Posts

2017 GLE350 4MATIC

Strictly speaking, a vehicle lease is an operating lease. Title is retained by the lessor. Operating leases are not accounted for on the balance sheet - they are "off balance sheet" financing. Enter into the grey zone.

Leases include a money factor. It's interest on the amount financed, plus profit to the lessor. It's a loan of sorts. It's debt of sorts. But it's not accounted for as debt. Still in the grey zone.

Using a lease allows one to allocate capital to other investments, for example equities. If the equity return exceeds the money factor or interest rate plus profit buried in the lease, it's financially more advantageous to lease. A money making machine resembling a perpetual motion device has been created. Another descriptor - a house of cards. Still in the grey zone.

A comment in the earlier posts mentioned leasing as a high cost alternative. I agree with this. Leasing is the highest total cost alternative.

Total cost of ownership, from lowest to highest, for a succession of vehicles over a period of decades:

1. Pay cash, DIY maintenance and repairs, operate to very high mileage, usually in excess of 200k miles

2. Bank loan, dealer or indy maintenance and repairs, operate to moderate mileage when repairs start to exceed the monthly payment of a replacement vehicle

3. Lease successively throughout the time period in question

I generally choose lowest total cost of ownership. Others choose differently. Leasing is generally chosen by people who have no desire or ability to DIY.

I address the capital allocation "benefit" of leasing by DIY-ing my own equity portfolio, and by selecting investments with higher return (and risk) than some people would select.

Leases include a money factor. It's interest on the amount financed, plus profit to the lessor. It's a loan of sorts. It's debt of sorts. But it's not accounted for as debt. Still in the grey zone.

Using a lease allows one to allocate capital to other investments, for example equities. If the equity return exceeds the money factor or interest rate plus profit buried in the lease, it's financially more advantageous to lease. A money making machine resembling a perpetual motion device has been created. Another descriptor - a house of cards. Still in the grey zone.

A comment in the earlier posts mentioned leasing as a high cost alternative. I agree with this. Leasing is the highest total cost alternative.

Total cost of ownership, from lowest to highest, for a succession of vehicles over a period of decades:

1. Pay cash, DIY maintenance and repairs, operate to very high mileage, usually in excess of 200k miles

2. Bank loan, dealer or indy maintenance and repairs, operate to moderate mileage when repairs start to exceed the monthly payment of a replacement vehicle

3. Lease successively throughout the time period in question

I generally choose lowest total cost of ownership. Others choose differently. Leasing is generally chosen by people who have no desire or ability to DIY.

I address the capital allocation "benefit" of leasing by DIY-ing my own equity portfolio, and by selecting investments with higher return (and risk) than some people would select.

Last edited by chassis; 06-13-2021 at 10:18 AM.

The following users liked this post:

MBNUT1 (06-13-2021)

#35

MBWorld Fanatic!

Leasing to me is too complicated. I like financing. I like only having to deal with 2 things. Selling price and interest rate. I know buying new cars is not an efficient use of money but, I enjoy new cars. As far as debt. With interest rates being so low, it makes no sense to me to take $60k out of the market to pay cash for a car. I donít pay cash for anything. I use rewards cards and pay off every month. We are retired. All our income is retirement income. So we pay federal taxes. Our state doesnít tax retirement income.

The following users liked this post:

chassis (06-13-2021)

#36

MBWorld Fanatic!

Join Date: Oct 2002

Location: Cincinnati

Posts: 4,292

Received 1,019 Likes

on

741 Posts

2010 E350 4Matic

Strictly speaking, a vehicle lease is an operating lease. Title is retained by the lessor. Operating leases are not accounted for on the balance sheet - they are "off balance sheet" financing. Enter into the grey zone.

Leases include a money factor. It's interest on the amount financed, plus profit to the lessor. It's a loan of sorts. It's debt of sorts. But it's not accounted for as debt. Still in the grey zone.

Using a lease allows one to allocate capital to other investments, for example equities. If the equity return exceeds the money factor or interest rate plus profit buried in the lease, it's financially more advantageous to lease. A money making machine resembling a perpetual motion device has been created. Another descriptor - a house of cards. Still in the grey zone.

A comment in the earlier posts mentioned leasing as a high cost alternative. I agree with this. Leasing is the highest total cost alternative.

Total cost of ownership, from lowest to highest, for a succession of vehicles over a period of decades:

1. Pay cash, DIY maintenance and repairs, operate to very high mileage, usually in excess of 200k miles

2. Bank loan, dealer or indy maintenance and repairs, operate to moderate mileage when repairs start to exceed the monthly payment of a replacement vehicle

3. Lease successively throughout the time period in question

I generally choose lowest total cost of ownership. Others choose differently. Leasing is generally chosen by people who have no desire or ability to DIY.

I address the capital allocation "benefit" of leasing by DIY-ing my own equity portfolio, and by selecting investments with higher return (and risk) than some people would select.

Leases include a money factor. It's interest on the amount financed, plus profit to the lessor. It's a loan of sorts. It's debt of sorts. But it's not accounted for as debt. Still in the grey zone.

Using a lease allows one to allocate capital to other investments, for example equities. If the equity return exceeds the money factor or interest rate plus profit buried in the lease, it's financially more advantageous to lease. A money making machine resembling a perpetual motion device has been created. Another descriptor - a house of cards. Still in the grey zone.

A comment in the earlier posts mentioned leasing as a high cost alternative. I agree with this. Leasing is the highest total cost alternative.

Total cost of ownership, from lowest to highest, for a succession of vehicles over a period of decades:

1. Pay cash, DIY maintenance and repairs, operate to very high mileage, usually in excess of 200k miles

2. Bank loan, dealer or indy maintenance and repairs, operate to moderate mileage when repairs start to exceed the monthly payment of a replacement vehicle

3. Lease successively throughout the time period in question

I generally choose lowest total cost of ownership. Others choose differently. Leasing is generally chosen by people who have no desire or ability to DIY.

I address the capital allocation "benefit" of leasing by DIY-ing my own equity portfolio, and by selecting investments with higher return (and risk) than some people would select.

The following users liked this post:

chassis (06-13-2021)

#37

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

As stated, this is one of the problems with our tax system. As far as leasing vs buying, my wife and I have had 32 cars. Bought all but one. That was leased. I like being able to buy a car or not buy in my time frame. I currently have a 2018 Bmw. That one will be traded in or sold when my C 300 cabriolet comes in. Before the warranty expires. The other car is a 2017 Acura MDX hybrid. Iím keeping it past the warranty period. I have already bought the extended warranty.

Leasing to me is too complicated. I like financing. I like only having to deal with 2 things. Selling price and interest rate. I know buying new cars is not an efficient use of money but, I enjoy new cars. As far as debt. With interest rates being so low, it makes no sense to me to take $60k out of the market to pay cash for a car. I donít pay cash for anything. I use rewards cards and pay off every month. We are retired. All our income is retirement income. So we pay federal taxes. Our state doesnít tax retirement income.

Leasing to me is too complicated. I like financing. I like only having to deal with 2 things. Selling price and interest rate. I know buying new cars is not an efficient use of money but, I enjoy new cars. As far as debt. With interest rates being so low, it makes no sense to me to take $60k out of the market to pay cash for a car. I donít pay cash for anything. I use rewards cards and pay off every month. We are retired. All our income is retirement income. So we pay federal taxes. Our state doesnít tax retirement income.

Leasing vs. buying: two scenarios: individual vs. business

Individual including retired people:

Under warranty, there are two costs of owning a car: depreciation and use of money: this is true whether you buy outright, finance or lease.

Depreciation is the difference between your cost and the value of your car at the time you decide to sell, trade or at lease end. When you lease the depreciation component is fixed: it is the difference between your cost and the residual. As 99% of all leases are "upside down" - that means that at lease end the residual is higher than the value of the car.

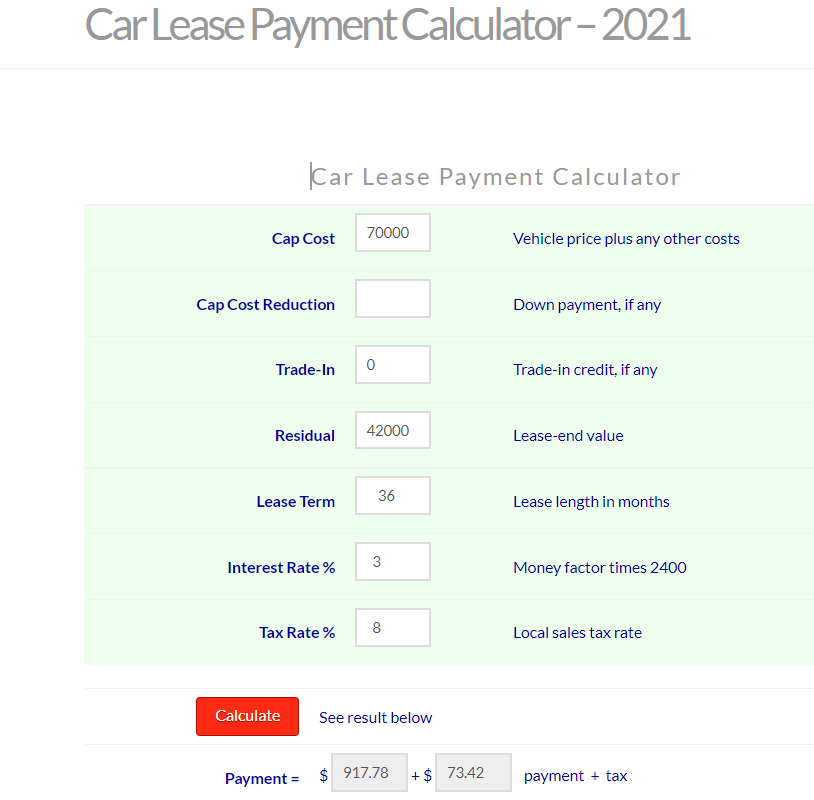

An example: MSRP is $75,000, negotiated cost is $70,000, residual for 36 months, 10,000 miles per year is 56%, the residual is 56% of MSRP $75,000 is $42,000. The depreciation component in the lease is $28,000: $70,000 less $42,000.

The MF (money factor) is a logarithmic calculation that is the interest component of a declining balance: Each monthly payment is a combination of depreciation and interest on the balance remaing. The MF can be converted into an interest equivalent by multiplying the MF by 2400.

If we assume an interest rate of 3%, sales tax at 8% the monthly payment on this example will be 991.17, total cost for 36 months $35,682.

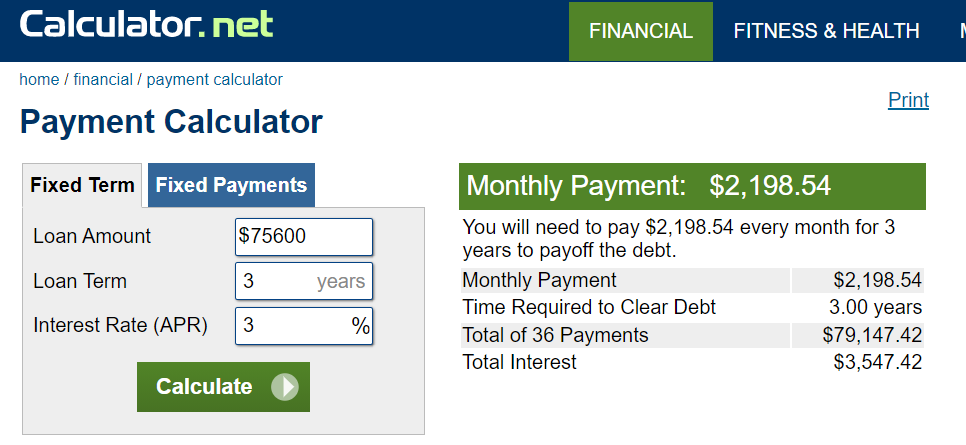

If you buy the car for $70,000 your tax at 8% will be $5,600 your cost out the door will be $75,600:

If you finance the car for 36 months @3% your monthly payment will be $2199, 36 months $79,147.

The difference between leasing, $35,862 and financing, $79,147 is $42,465 which is 56% of MSRP)

If your Mercedes at the end of three years is worth $42,465 or more than financing will be cheaper than leasing. If less than $42,465 more expensive than financing.

But keep in mind that a given is that 99% of all leases are "upside down": the residual is higher than than the value: that means after three years the Mercedes will be less than $42,465 and that means leasing will be less expensive than buying.

The break even for buying vs. leasing is 6 years: After 6 years it is cheaper to buy than to lease.

But keep in mind that technology is rapidly evolving and we can assume that a car three years from now will not only be more technologically advance but much, much safer. To me safety is extremely importang.

If you decide to pay for the car and not finance, unless you have money under a mattress earning zero interest, I am assuming the $75600 is invested and earning at a minimum 3%. If that is the case you true economic cost is the same as financing at 3%. If you investments are earning more than 3%, then your true economic cost is even either.

Business:

Here again I choose to make complex things simple - not simple things complex.

For tax purposes 99% of all business expense either 5/7, 6/7 or 7/7 of the cost of a lease in the year that the lease payments are made. (5 days out of 7, 6 out 7 or 7 out 7 for business use) That is why most small business choose to lease rather than buy: When you buy you must keep detailed records as to miles driven and depreciation of a auto are complex.

Hope this clarifies.

#38

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Strictly speaking, a vehicle lease is an operating lease. Title is retained by the lessor. Operating leases are not accounted for on the balance sheet - they are "off balance sheet" financing. Enter into the grey zone.

Leases include a money factor. It's interest on the amount financed, plus profit to the lessor. It's a loan of sorts. It's debt of sorts. But it's not accounted for as debt. Still in the grey zone.

Using a lease allows one to allocate capital to other investments, for example equities. If the equity return exceeds the money factor or interest rate plus profit buried in the lease, it's financially more advantageous to lease. A money making machine resembling a perpetual motion device has been created. Another descriptor - a house of cards. Still in the grey zone.

A comment in the earlier posts mentioned leasing as a high cost alternative. I agree with this. Leasing is the highest total cost alternative.

Total cost of ownership, from lowest to highest, for a succession of vehicles over a period of decades:

1. Pay cash, DIY maintenance and repairs, operate to very high mileage, usually in excess of 200k miles

2. Bank loan, dealer or indy maintenance and repairs, operate to moderate mileage when repairs start to exceed the monthly payment of a replacement vehicle

3. Lease successively throughout the time period in question

I generally choose lowest total cost of ownership. Others choose differently. Leasing is generally chosen by people who have no desire or ability to DIY.

I address the capital allocation "benefit" of leasing by DIY-ing my own equity portfolio, and by selecting investments with higher return (and risk) than some people would select.

Leases include a money factor. It's interest on the amount financed, plus profit to the lessor. It's a loan of sorts. It's debt of sorts. But it's not accounted for as debt. Still in the grey zone.

Using a lease allows one to allocate capital to other investments, for example equities. If the equity return exceeds the money factor or interest rate plus profit buried in the lease, it's financially more advantageous to lease. A money making machine resembling a perpetual motion device has been created. Another descriptor - a house of cards. Still in the grey zone.

A comment in the earlier posts mentioned leasing as a high cost alternative. I agree with this. Leasing is the highest total cost alternative.

Total cost of ownership, from lowest to highest, for a succession of vehicles over a period of decades:

1. Pay cash, DIY maintenance and repairs, operate to very high mileage, usually in excess of 200k miles

2. Bank loan, dealer or indy maintenance and repairs, operate to moderate mileage when repairs start to exceed the monthly payment of a replacement vehicle

3. Lease successively throughout the time period in question

I generally choose lowest total cost of ownership. Others choose differently. Leasing is generally chosen by people who have no desire or ability to DIY.

I address the capital allocation "benefit" of leasing by DIY-ing my own equity portfolio, and by selecting investments with higher return (and risk) than some people would select.

#1: Pay Cash:

Do you know anyone, especially retired people, who have the knowledge, skill and diagnostic tools, which cost thousands of dollars to do their own repairs on a high mileage Mercedes? Those are few and far between and I suggest so small in number to be inconsequential. For all practical purposes, most people can scratch #1.

#2: Bank Loan:

See my post above where you must own for a minimum of 6 years before financing is cheaper than leasing. Add in technological advances and more important safety advantages, and to me, driving an older car vs. a new car is less and less desirous.

That is why over 80% of all Mercedes are leased.

The following users liked this post:

chassis (06-13-2021)

#39

Out Of Control!!

Join Date: Sep 2018

Location: unbegrenzt

Posts: 13,407

Received 3,967 Likes

on

3,119 Posts

2017 GLE350 4MATIC

In theory you are correct but what about real world?

#1: Pay Cash:

Do you know anyone, especially retired people, who have the knowledge, skill and diagnostic tools, which cost thousands of dollars to do their own repairs on a high mileage Mercedes? Those are few and far between and I suggest so small in number to be inconsequential. For all practical purposes, most people can scratch #1.

#2: Bank Loan:

See my post above where you must own for a minimum of 6 years before financing is cheaper than leasing. Add in technological advances and more important safety advantages, and to me, driving an older car vs. a new car is less and less desirous.

That is why over 80% of all Mercedes are leased.

#1: Pay Cash:

Do you know anyone, especially retired people, who have the knowledge, skill and diagnostic tools, which cost thousands of dollars to do their own repairs on a high mileage Mercedes? Those are few and far between and I suggest so small in number to be inconsequential. For all practical purposes, most people can scratch #1.

#2: Bank Loan:

See my post above where you must own for a minimum of 6 years before financing is cheaper than leasing. Add in technological advances and more important safety advantages, and to me, driving an older car vs. a new car is less and less desirous.

That is why over 80% of all Mercedes are leased.

Mercedes repair and maintenance is trivially easy, provided a person has a grounding in car repair and tools. For example, having had experience working on a 1976 Chevette. That's good enough for a basic level of skill and tools. Any remaining gap can be closed with desire and a nearby auto parts store (Advance Auto, AutoZone) and tool retailer such as Lowe's or Harbor Freight. The work is dead simple, trivially so.

Zero electronic diagnostic equipment is needed for scheduled repair and maintenance, with the exception of transmission fluid replacement. Transmission fluid replacement requires accurate measurement of transmission oil temperature, and this can be done with a third party OBD tool. No dealer required. I choose to let the dealer do this job because it's a pain even for experienced DIYers.

What is your definition of retired? What if a person is retired at age 40? Age 50? Age 60? Age 70? There are 70+ year olds doing major DIY work on this site and others. There are millions of people in the world retired "early". Retirement status has zero bearing on choice of car maintenance and repair.

Desire is the only thing that matters on whether or not one DIYs or not. Even a person with zero ability, if they have desire, can carry out 100% of scheduled repair and maintenance tasks on a modern Mercedes. The work is trivially easy.

The P&L (profit and loss, or income statement) for vehicle acquisition is:

1. capital outlay (down payment or cash purchase)

2. + cost of renting another's money (interest rate or a portion of the money factor)

3. + profit and commission embedded in renting another's money and the origination of the lease or loan (a portion of the money factor)

4. + depreciation

5. + applicable taxes

6. - resale price, if any

1. Might be zero in the case of zero down loans or leases

2. Might be zero in the case of a cash purchase

3. Might be zero in the case of a cash purchase

4. Everyone pays this, without exception

5. Everyone pays this, even if they think they aren't

6. Zero if leasing. Greater than zero even if running the vehicle to 200k+ miles. A running vehicle with full service history always has value to someone.

Where is the 80% statistic coming from? Please provide a link. This from 2016 suggests a little more than half of Mercedes buyers lease. https://www.caranddriver.com/news/a1...nly-purchased/

I can think of a reason Mercedes are leased - they are expensive garbage, in general. Low quality vehicles have higher percentage of lease transactions than Mercedes. This puts MB among sketchy peers.

No one wants to be holding the bag when a piston cracks, the 48V battery dies, engine has unexplainable misfires, the MBUX goes on the fritz, or the air suspension stops holding the vehicle up. It's a "lucky" person that owns a modern Mercedes beyond the warranty period without an egregious failure that no vehicle at MB's price point should incur. Leasing is a way to avoid holding the soggy bag of Mercedes' poor reliability.

Last edited by chassis; 06-13-2021 at 03:55 PM.

#40

MBWorld Fanatic!

At my age monetary efficiency is no longer a consideration. My wife and I are the last of our bloodline. My monthly income far exceeds my spending.

@ JTK44

As of the 2020 tax year, you'll fall into the 0% long-term capital gains tax rate for qualified dividends if:

@ JTK44

As of the 2020 tax year, you'll fall into the 0% long-term capital gains tax rate for qualified dividends if:

- Your income is less than $40,000 if you're single

- Your income is less than $80,000 if you're married and you file a joint return with your spouse

- Your income is less than $53,600 if you qualify as head of household

- $441,449 for single filers

- $469,049 for head of household filers

- $496,599 for married filers of joint returns in 2020

The following users liked this post:

chassis (06-13-2021)

#41

MBWorld Fanatic!

Of course holding on to a car for 6 years is cheaper. I usually keep cars close to 4 years. Too long for a lease. I finance for 5 years because of the low interest rates. I pay more in interest but, that money I’m not putting out monthly is usually earning more. My bmw I’m only keeping 3 years because it was an executive car and the warranty clock had started before I bought it.

Then there are people who lease then buy after the lease is up. Normally that makes no sense to me. However, these are not normal times.

Then there are people who lease then buy after the lease is up. Normally that makes no sense to me. However, these are not normal times.

The following users liked this post:

chassis (06-13-2021)

#42

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

@JTK44 Do you mind disclosing whether or not you now or in the past are/have been employed in, or receive compensation from a car dealer or financial services firm? My disclosure to that question is "no". Your posts support the business (profit generation) model of a dealer or lender/leasing company. Do you agree?

Mercedes repair and maintenance is trivially easy, provided a person has a grounding in car repair and tools. For example, having had experience working on a 1976 Chevette. That's good enough for a basic level of skill and tools. Any remaining gap can be closed with desire and a nearby auto parts store (Advance Auto, AutoZone) and tool retailer such as Lowe's or Harbor Freight. The work is dead simple, trivially so.

Zero electronic diagnostic equipment is needed for scheduled repair and maintenance, with the exception of transmission fluid replacement. Transmission fluid replacement requires accurate measurement of transmission oil temperature, and this can be done with a third party OBD tool. No dealer required. I choose to let the dealer do this job because it's a pain even for experienced DIYers.

Where is the 80% statistic coming from? Please provide a link. This from 2016 suggests a little more than half of Mercedes buyers lease. https://www.caranddriver.com/news/a1...nly-purchased/

No one wants to be holding the bag when a piston cracks, the 48V battery dies, engine has unexplainable misfires, the MBUX goes on the fritz, or the air suspension stops holding the vehicle up. It's a "lucky" person that owns a modern Mercedes beyond the warranty period without an egregious failure that no vehicle at MB's price point should incur. Leasing is a way to avoid holding the soggy bag of Mercedes' poor reliability.

Which one is it: A fine auto that anyone who was able to work on a 1976 Chevette can maintain or an " expensive piece of garbage".

I do not think it can be both.

The following 2 users liked this post by JTK44:

allfortheunion (06-13-2021),

chassis (06-13-2021)

#43

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

At my age monetary efficiency is no longer a consideration. My wife and I are the last of our bloodline. My monthly income far exceeds my spending.

@ JTK44

As of the 2020 tax year, you'll fall into the 0% long-term capital gains tax rate for qualified dividends if:

@ JTK44

As of the 2020 tax year, you'll fall into the 0% long-term capital gains tax rate for qualified dividends if:

- Your income is less than $40,000 if you're single

- Your income is less than $80,000 if you're married and you file a joint return with your spouse

- Your income is less than $53,600 if you qualify as head of household

- $441,449 for single filers

- $469,049 for head of household filers

- $496,599 for married filers of joint returns in 2020

Assuming you have social security:

- file a federal tax return as an "individual" and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

- file a joint return, and you and your spouse have a combined income* that is

- between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $44,000, up to 85 percent of your benefits may be taxable.

Assuming you have no other taxable income, your social security may make your dividend income taxable and your dividend income may make your social security income taxable.

Of course Roth distributions are not taxable: Roth IRA's are funded with after tax income - you already paid the tax.

BTW, with a Roth IRA there is a trap many people fall into: during their lifetime that may have created a Roth with expensive after tax dollars or rolled a 401(k) or traditional IRA into a ROTH when they were in a high tax bracket, only to find out that when they take the money out they are paying little to no tax - apparently your situation. But that is a digression.

The following users liked this post:

chassis (06-13-2021)

#44

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Because of Covid-19 and the lack of supply of new cars, some used cars have appreciated in value.

My 2018 Ford Edge Sport which I lease has a residual value, (buy back), in September 2021 of $25,264. At this time last year the blue book value of my Edge Sport was about $28,000. If it continued to depreciate, over the 16 months, it would have been worth less than $25,264 and I would have turned the car in.

Two months ago the blue book on the same car was $32,000. Today it is $35,000!

This is all because of lack of supply related to Covid 19 and lack of chips which is limiting manufacturing.

During the same period the blue book on my 2019 E450 has remained the same - over the past 12 months there was neither increase or decrease. Today the blue book is $45,500. My lease ends in 6 months, December 30, 2021. The residual on my lease is $41,946. If I buy the car I must pay 8.625% tax, which brings my cost up to $44,749 about what the car is worth today. I assume over the next 6 months my Mercedes, unlike the Edge Sport, will start to depreciate and at lease end my cost will be greater than its value and I will return the car.

#45

MBWorld Fanatic!

I rolled my IRA into a Roth during a year that I had a very large loss, thus no tax on the rollover.

I do not have social security that is taxable. Of course there is the $27,400 standard deduction that bumps the zero bracket above $100k

I do not like income taxes. I'd rather pay taxes based on consumption such as value added taxes or other kinds of sales taxes.

I also do not like ad valorem taxes that tax fixed assets based on their value which will eventually deplete the asset. It is a form of slow confiscation.

I do not have social security that is taxable. Of course there is the $27,400 standard deduction that bumps the zero bracket above $100k

I do not like income taxes. I'd rather pay taxes based on consumption such as value added taxes or other kinds of sales taxes.

I also do not like ad valorem taxes that tax fixed assets based on their value which will eventually deplete the asset. It is a form of slow confiscation.

The following users liked this post:

chassis (06-13-2021)

#46

Out Of Control!!

Join Date: Sep 2018

Location: unbegrenzt

Posts: 13,407

Received 3,967 Likes

on

3,119 Posts

2017 GLE350 4MATIC

No worries. Disagreeing is OK.

So you in the past have receive remuneration from a retail auto sales and/or service business. This post I believe, because it is consistent with your other posts. Thanks for clarifying this, it helps to increase understanding. Across multiple car discussion sites like this, posters who are now receiving, or who have in the past received, monetary consideration for their time and talent in the retail automotive sales and service industry make posts similar to yours.

You are mistaken, but that's OK.  Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

Correct, I disclosed that the linked article is from 2016, so you are good at math. Well done. You provided no link to your source. And you shifted your statement from "Mercedes" to E and S Classes. Please provide a link to the source for your claim. Thanks!

I said trivially easy. Almost as easy as a 1976 Chevette. I made no comment on cost. MBs are indeed both expensive garbage and trivially easy to maintain.

Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

I said trivially easy. Almost as easy as a 1976 Chevette. I made no comment on cost. MBs are indeed both expensive garbage and trivially easy to maintain.

Last edited by chassis; 06-13-2021 at 07:38 PM.

#47

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

No worries. Disagreeing is OK.

So you in the past have receive remuneration from a retail auto sales and/or service business. This post I believe, because it is consistent with your other posts. Thanks for clarifying this, it helps to increase understanding. Across multiple car discussion sites like this, posters who are now receiving, or who have in the past received, monetary consideration for their time and talent in the retail automotive sales and service industry make posts similar to yours.

You are mistaken, but that's OK. Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

Correct, I disclosed that the linked article is from 2016, so you are good at math. Well done. You provided no link to your source. And you shifted your statement from "Mercedes" to E and S Classes. Please provide a link to the source for your claim. Thanks!

I said trivially easy. Almost as easy as a 1976 Chevette. I made no comment on cost. MBs are indeed both expensive garbage and trivially easy to maintain.

So you in the past have receive remuneration from a retail auto sales and/or service business. This post I believe, because it is consistent with your other posts. Thanks for clarifying this, it helps to increase understanding. Across multiple car discussion sites like this, posters who are now receiving, or who have in the past received, monetary consideration for their time and talent in the retail automotive sales and service industry make posts similar to yours.

You are mistaken, but that's OK.

Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.

Indeed I am talking about oil and filter changes. And brake pads/rotors, engine air filters, spark plugs, brake fluid, coolant, wipers, cabin air filters, front axle oil, rear axle oil, transfer case oil and batteries. And more. It's all trivially easy. No dealer required. No paid mechanic required. Just desire. It's like a 1976 Chevette. Or 2005 4Runner. Or 1989 F-150. It's all nearly the same.Correct, I disclosed that the linked article is from 2016, so you are good at math. Well done. You provided no link to your source. And you shifted your statement from "Mercedes" to E and S Classes. Please provide a link to the source for your claim. Thanks!

I said trivially easy. Almost as easy as a 1976 Chevette. I made no comment on cost. MBs are indeed both expensive garbage and trivially easy to maintain.

You seem to be put off by my financial calculations: If they are incorrect point out the error.

Your statements about the work, that requires putting a car on a lift, to do is trivial I think is just silly. I will leave it to other forum members to decide is this is the type of work they can do.

Can you please tell me where in the owner's manual is the requirement to change the "front axle oil".

Thanks.

The following users liked this post:

chassis (06-14-2021)

#49

Out Of Control!!

Join Date: Sep 2018

Location: unbegrenzt

Posts: 13,407

Received 3,967 Likes

on

3,119 Posts

2017 GLE350 4MATIC

You found me out Inspector Inspector Clouseau: While I was in VISTA between 1969 and 1971, which paid me $35 every two weeks, I "moonlighted" as an auto mechanic!

You seem to be put off by my financial calculations: If they are incorrect point out the error.

Your statements about the work, that requires putting a car on a lift, to do is trivial I think is just silly. I will leave it to other forum members to decide is this is the type of work they can do.

Can you please tell me where in the owner's manual is the requirement to change the "front axle oil".

Thanks.

You seem to be put off by my financial calculations: If they are incorrect point out the error.

Your statements about the work, that requires putting a car on a lift, to do is trivial I think is just silly. I will leave it to other forum members to decide is this is the type of work they can do.

Can you please tell me where in the owner's manual is the requirement to change the "front axle oil".

Thanks.

Who uses a lift to DIY scheduled maintenance?

Fully agree with you that vehicle owners of any brand should be the deciders on what, if any, DIY maintenance they do on their vehicles.

I'm changing my engine oil at 70k miles later this week. I bought the oil and filter today at Advance Auto, in stock. That was both enjoyable and trivially easy.

#50

MBWorld Fanatic!

Join Date: May 2018

Location: Long Island, NY

Posts: 2,081

Received 594 Likes

on

450 Posts

2019 E 450, 2016 E350 4matic (retired), 2018 Ford Edge Sport, 2008 Porsche Boxster

Axle oil change is not specified by Mercedes, sadly. I changed both of my axles' oil, and transfer case oil at 68k miles. A job worth doing, with Mercedes' poor track record on SUV transfer cases.

Who uses a lift to DIY scheduled maintenance?

Fully agree with you that vehicle owners of any brand should be the deciders on what, if any, DIY maintenance they do on their vehicles.

I'm changing my engine oil at 70k miles later this week. I bought the oil and filter today at Advance Auto, in stock. That was both enjoyable and trivially easy.

Who uses a lift to DIY scheduled maintenance?

Fully agree with you that vehicle owners of any brand should be the deciders on what, if any, DIY maintenance they do on their vehicles.

I'm changing my engine oil at 70k miles later this week. I bought the oil and filter today at Advance Auto, in stock. That was both enjoyable and trivially easy.

Then wait 10/15 minutes and then go back under the car to replace the drain plug. Then replace the oil and go a third time under the car to make sure there are no leaks from either the oil pan or the filter.

For you trivial work maybe - for the rest of us - no thanks.