STATES LOOKING AT MILEAGE TAX OVER GAS TAX

#26

Super Member

Join Date: Jun 2003

Location: Aridzona

Posts: 642

Received 83 Likes

on

72 Posts

'15 S550, '10 E350 P1/P2, '02 ML320

I would think we are all less naive than to believe this is anything but a politcal ploy. The estimated $200M tax to be collected under this plan is but a drop in the bucket of the $27B annual budget deficit California is enjoying.

#27

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,400

Received 2,673 Likes

on

1,714 Posts

2020 S560 4Matic

We don’t have a revenue problem. We have an expenditure problem. Like politicians giving away billions in foreign aid, to get millions back as kickbacks. We have too many putting themselves first, their pet causes next, and the taxpayers last. The green new deal was budgeted at 80 trillion, as I recall. I didn’t get too worried about it, because it was so utterly preposterous, that it wouldn’t be taken seriously. But then I forgot that in politics, if the taxpayer resists, you just steamroll them, and then shove it down their throats.

If you could show me that reductions in spending could reduce the tax burdens of most normal Americans I would be all for it.

The following users liked this post:

MBNUT1 (05-30-2024)

#28

Super Member

Join Date: Aug 2007

Location: Pacific Northwest

Posts: 533

Received 199 Likes

on

131 Posts

2001 S600 V12 Sold, 2011 Jaguar XFR Sold, 2017 S550 4-Matic, 2018 S63 AMG Sedan

I went bald a few years back and have missed going to the barbershop. I feel like I'm back in, and I get to keep my $25 in my pocket...THANKS GUYS!!

The following users liked this post:

SW20S (05-30-2024)

#29

Super Member

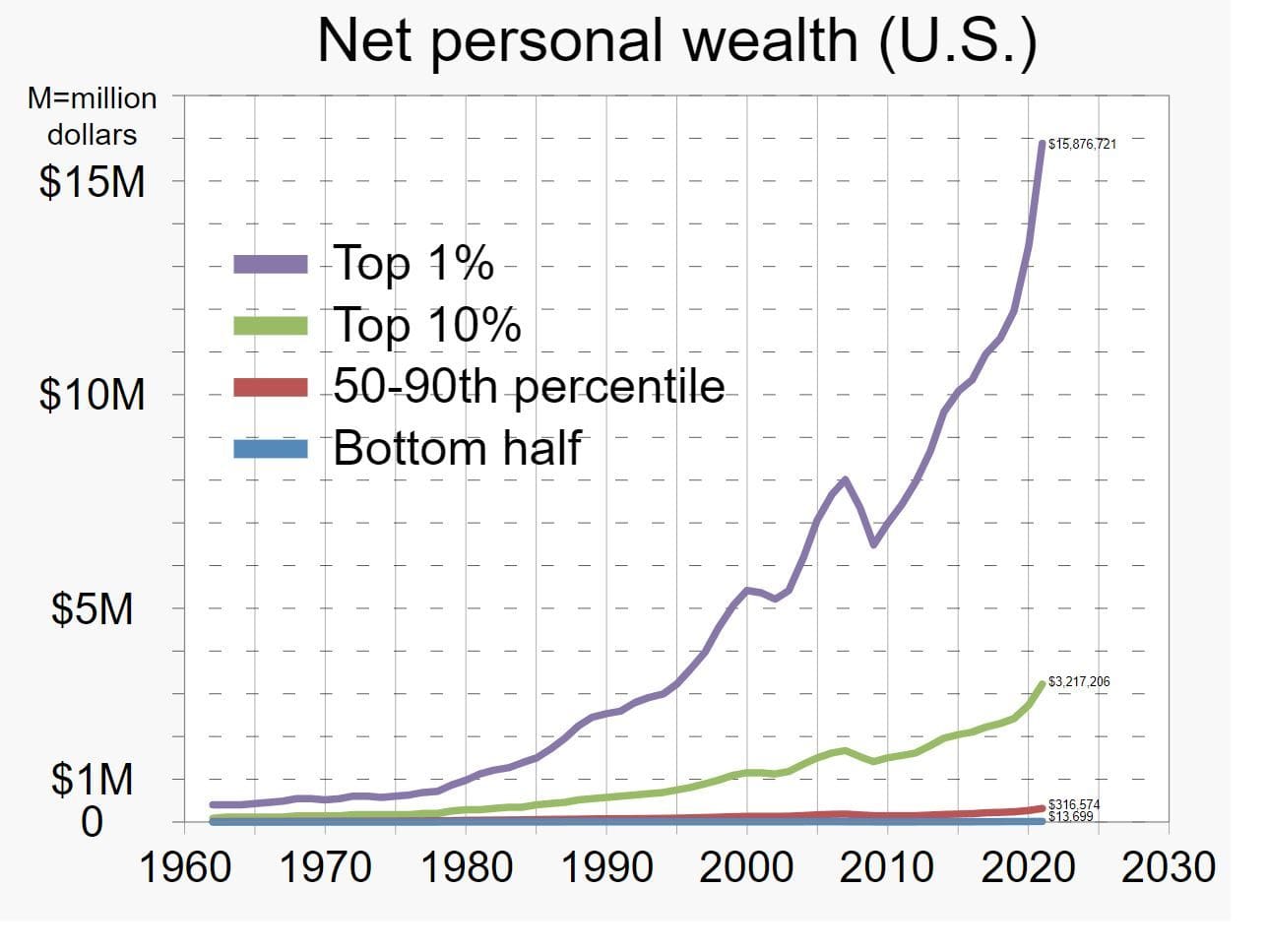

This is both true and not true. Of course we do have an expenditure problem, but we also have a tax code that unfairly burdens the middle and lower class and unfairly benefits those with high and complex incomes. Hey, I benefit from it...my effective tax rate is about 7%, Uncle Sam pays half my S Class payment and half of all its fuel, maintenance etc but it is totally insane that I have the ability to loophole my income to where I only pay 7% in federal taxes where a teacher making $80,000 was to pay 22% of their income in taxes. That's completely crazy.

If you could show me that reductions in spending could reduce the tax burdens of most normal Americans I would be all for it.

If you could show me that reductions in spending could reduce the tax burdens of most normal Americans I would be all for it.

As for reductions in spending, there is a reduction strategy called the penny plan. Every federal organization that submits a budget, would have to reduce the next year”s budget by 1%/yr, and continue to do so until a surplus was realized. Then, apply that surplus to the National Debt, and pay it down, until it is paid off. We can’t have guys like Fauci being paid more than the President. We also can’t have bloated bureaucracies growing in cost under their own volition. That’s an inherent weakness of any bureaucracy.

#30

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,400

Received 2,673 Likes

on

1,714 Posts

2020 S560 4Matic

I don’t react positively to fair share. If you earn $1million, and have an effective rate of 7%, that is a tax burden of $70,000.00. The $80,000.00 teachers paying 22% is a tax burden of $17,600. In dollar terms, 1 or both of you are not paying your fair share. My suspicion is that you both are paying more than your fair share. Unless every income earner pays the exact same dollar amount, it’s not fair, in this case fair is defined by equal.

We can’t have guys like Fauci being paid more than the President.

The President makes $400,000. If we won't pay anybody more than $400,000 we're missing out on a lot of top talent. Make them all pay 30% of their income in taxes like everybody else and we'll be fine lol

Last edited by SW20S; 05-30-2024 at 06:58 PM.

The following users liked this post:

MBNUT1 (05-30-2024)

#31

MBWorld Fanatic!

Steve...

Do some math for how many $$$ may come in from those who have made good choices (or inherited them) annually at 30% tax rate.

Be sure to factor into your math how many of those big $$$ earners will ‘Nope out’ as those of means are able to decide to MOVE somewhere that tax rates are more reasonable.

The only way to really solve for a balanced budget is to get ‘Our friends in government’ to reduce what they spend. History tells us they are loath to do so.

Do some math for how many $$$ may come in from those who have made good choices (or inherited them) annually at 30% tax rate.

Be sure to factor into your math how many of those big $$$ earners will ‘Nope out’ as those of means are able to decide to MOVE somewhere that tax rates are more reasonable.

The only way to really solve for a balanced budget is to get ‘Our friends in government’ to reduce what they spend. History tells us they are loath to do so.

The following users liked this post:

MB2timer (06-01-2024)

The following users liked this post:

MB2timer (06-01-2024)

#33

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,400

Received 2,673 Likes

on

1,714 Posts

2020 S560 4Matic

Steve...

Do some math for how many $$$ may come in from those who have made good choices (or inherited them) annually at 30% tax rate.

Be sure to factor into your math how many of those big $$$ earners will ‘Nope out’ as those of means are able to decide to MOVE somewhere that tax rates are more reasonable.

The only way to really solve for a balanced budget is to get ‘Our friends in government’ to reduce what they spend. History tells us they are loath to do so.

Do some math for how many $$$ may come in from those who have made good choices (or inherited them) annually at 30% tax rate.

Be sure to factor into your math how many of those big $$$ earners will ‘Nope out’ as those of means are able to decide to MOVE somewhere that tax rates are more reasonable.

The only way to really solve for a balanced budget is to get ‘Our friends in government’ to reduce what they spend. History tells us they are loath to do so.

And those big earners, they're not going to leave the country because they have to pay their fair share of taxes. They won't go anywhere else where they won't have to pay more taxes, their businesses and incomes are here. This whole "don't tax high earners and corporations because they will leave" is just scare tactics to try and convince lower earning people its okay that people who make high 6 and 7 figures+ don't have to pay anywhere near the same % of taxes as they do.

Of course spending also needs to be reigned in...but this is a fundamental problem that also needs to be solved. People who earn high incomes should be made to pay the same % of their income as people who earn lower incomes.

Last edited by SW20S; 06-01-2024 at 11:19 AM.

The following users liked this post:

MBNUT1 (06-01-2024)

#34

Super Member

How does making good choices or inheriting good choices mean somebody shouldn't have to pay the same tax rates as people who earn less money? Are you saying that everybody who makes less than $1M a year has made bad choices? Come on lol.

And those big earners, they're not going to leave the country because they have to pay their fair share of taxes. They won't go anywhere else where they won't have to pay more taxes, their businesses and incomes are here. This whole "don't tax high earners and corporations because they will leave" is just scare tactics to try and convince lower earning people its okay that people who make high 6 and 7 figures+ don't have to pay anywhere near the same % of taxes as they do.

Of course spending also needs to be reigned in...but this is a fundamental problem that also needs to be solved. People who earn high incomes should be made to pay the same % of their income as people who earn lower incomes.

And those big earners, they're not going to leave the country because they have to pay their fair share of taxes. They won't go anywhere else where they won't have to pay more taxes, their businesses and incomes are here. This whole "don't tax high earners and corporations because they will leave" is just scare tactics to try and convince lower earning people its okay that people who make high 6 and 7 figures+ don't have to pay anywhere near the same % of taxes as they do.

Of course spending also needs to be reigned in...but this is a fundamental problem that also needs to be solved. People who earn high incomes should be made to pay the same % of their income as people who earn lower incomes.

And yes, Fauci in particular should NOT be making more than the US President. We should NOT be trying to attract talent with money. We should value service, and suitability for government positions.

#35

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,400

Received 2,673 Likes

on

1,714 Posts

2020 S560 4Matic

Sorry, this whole argument is ridiculous lol. Whether or not you think someone has made “bad choices” has no bearing on what they should be taxed. People should be taxed a percentage of their income, and that percentage should not go down the more someone makes after a certain point. The tax code is already there, the loopholes just have to removed so that high earners can’t shield their income from taxes in ways lower earners can’t.

As for the whole “people who earn less than $1M make poor choices and are financially illiterate” is just elitist BS. Very few people make incomes like that (I don’t), not everybody is in a position where they even can. The world needs everybody else too. Teachers haven’t “made poor choices” which have led them to be teachers.

As for the whole “people who earn less than $1M make poor choices and are financially illiterate” is just elitist BS. Very few people make incomes like that (I don’t), not everybody is in a position where they even can. The world needs everybody else too. Teachers haven’t “made poor choices” which have led them to be teachers.

The following users liked this post:

MBNUT1 (06-01-2024)

#36

MBWorld Fanatic!

Join Date: Oct 2002

Location: Cincinnati

Posts: 4,240

Received 987 Likes

on

723 Posts

2010 E350 4Matic

The first one that I heard make the case about how unfair the tax system was to lower income level (workers) was Warren Buffet, who said he paid a lower tax rate than his secretary. He went on to say that there is class warfare and his class is winning.

Last edited by MBNUT1; 06-01-2024 at 04:55 PM.

The following users liked this post:

SW20S (06-01-2024)

#37

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,400

Received 2,673 Likes

on

1,714 Posts

2020 S560 4Matic

There are a lot of high earning/wealthy people who have said the same thing as WB. I don't consider myself wealthy but I make very good income, and while nobody wants to pay taxes like I said, its totally absurd that I can get to a 7% effective tax rate and have that all be completely legal.

The following users liked this post:

MBNUT1 (06-01-2024)

#38

MBWorld Fanatic!

This is both true and not true. Of course we do have an expenditure problem, but we also have a tax code that unfairly burdens the middle and lower class and unfairly benefits those with high and complex incomes. Hey, I benefit from it...my effective tax rate is about 7%, Uncle Sam pays half my S Class payment and half of all its fuel, maintenance etc but it is totally insane that I have the ability to loophole my income to where I only pay 7% in federal taxes where a teacher making $80,000 was to pay 22% of their income in taxes. That's completely crazy.

If you could show me that reductions in spending could reduce the tax burdens of most normal Americans I would be all for it.

If you could show me that reductions in spending could reduce the tax burdens of most normal Americans I would be all for it.

You choose (wisely) to take advantage of legal write offs. Much different than Uncle Sam sending you a check for it.

Should you be suffering guilt about the percentage of your adjusted gross income that you get to send to .fed quarterly you are more than welcome to send more. Bet you could even ask that it go toward the federal (all of our) debt. If every high earner did the same it wouldn’t be enough. Government needs to spend less.

#39

No, we have a both problem. We bring in too little and pay out too much.

We had a LOT fewer immigrants across the southern boarder when we spent lavishly on foreign aid.

Ask not what your country can do for you,.....

$80B is a basic rounding error in the current budget.

Those who remember can remember those things at election time.

Like politicians giving away billions in foreign aid, to get millions back as kickbacks.

We have too many putting themselves first, their pet causes next, and the taxpayers last.

The green new deal was budgeted at 80 trillion, as I recall. I didn’t get too worried about it, because it was so utterly preposterous, that it wouldn’t be taken seriously. But then I forgot that in politics,

if the taxpayer resists, you just steamroll them, and then shove it down their throats.

#40

a) $30M fighter jets (instead of $135M) you can have 4× as many ... {tanks, frigates, carriers, missles, ...}

b) $0 in corporate welfare--if your business is not successful you should go out of business ...

c) $0 in agricultural welfare--if you can't make it as a farmer--let someone else try ...

d) create an environment where Americans pay less for medicines than anywhere/everywhere else in the world.

Get business to agree to the above, and liberals will agree to

d) $0 in long term welfare (longer than 1 year)

{We as a country are willing to pick you up, dust you off, give you a new start, and then it is all up to you.}

#41

Super Member

We are getting a bit off topic, but I am not 1 bit persuaded by any of your arguments or assertions. Why did you say 80B? Alexandria Occasional Cortex presented it with as wish list and a budget of 80 TRILLION. That is my recollection.

#42

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,400

Received 2,673 Likes

on

1,714 Posts

2020 S560 4Matic

Believing that the tax code unfairly benefits people with high incomes does not mean I am in favor of policies like that or that I don’t believe spending needs to be controlled.

Republicans are always in favor of tax cuts tax cuts tax cuts, it’s just that their tax cuts typically only benefit people with high incomes, and where they want to cut only hurts people who rely on government services and entitlements. I don’t need a tax cut, and I won’t need social security. My kids teacher needs both. So if you want to cut her social security and increase her taxes by capping the SALT as an example so I can pay 5% instead of 7%, no thanks. Make me pay 25% and leave her alone.

Republicans are always in favor of tax cuts tax cuts tax cuts, it’s just that their tax cuts typically only benefit people with high incomes, and where they want to cut only hurts people who rely on government services and entitlements. I don’t need a tax cut, and I won’t need social security. My kids teacher needs both. So if you want to cut her social security and increase her taxes by capping the SALT as an example so I can pay 5% instead of 7%, no thanks. Make me pay 25% and leave her alone.

Last edited by SW20S; 06-02-2024 at 11:30 AM.

The following users liked this post:

MBNUT1 (06-02-2024)

#43

MBWorld Fanatic!

Cutting taxes makes for more investment.... Growing the economy... More people make more money which brings more $$$ to our friends at .Gov.

Fifty cents in a bet says not a one of us has been employed by a guy who didn’t have two nickels to rub together.

We cannot tax our way to prosperity.

Never ending ‘benefits’ does not encourage work.

I’m all for a hand up. Not never ending hand outs.

Fifty cents in a bet says not a one of us has been employed by a guy who didn’t have two nickels to rub together.

We cannot tax our way to prosperity.

Never ending ‘benefits’ does not encourage work.

I’m all for a hand up. Not never ending hand outs.

Last edited by JohnLane; 06-02-2024 at 12:30 PM.

The following users liked this post:

MB2timer (06-03-2024)

#44

MBWorld Fanatic!

Join Date: Oct 2002

Location: Cincinnati

Posts: 4,240

Received 987 Likes

on

723 Posts

2010 E350 4Matic

Cutting taxes makes for more investment.... Growing the economy... More people make more money which brings more $$$ to our friends at .Gov.

Fifty cents in a bet says not a one of us has been employed by a guy who didn’t have two nickels to rub together.

We cannot tax our way to prosperity.

Never ending ‘benefits’ does not encourage work.

I’m all for a hand up. Not never ending hand outs.

Fifty cents in a bet says not a one of us has been employed by a guy who didn’t have two nickels to rub together.

We cannot tax our way to prosperity.

Never ending ‘benefits’ does not encourage work.

I’m all for a hand up. Not never ending hand outs.

Last edited by MBNUT1; 06-02-2024 at 01:06 PM.

#45

Super Member

The Reagan tax cuts that the “lib’s” love to demonize as “trickle down” ACTUALLY WORKED. Revenues to the treasury immediately doubled. What did the lib’s(with some help by Rino’s) do? They immediately tripled spending. With a race like that, what wins?

Money ABSOLUTELY DOES trickle down. People with money want nice cars, clothes, houses, second houses, renovations, boats. Who does that money trickle down to? Blue collar, and white collar workers filling those jobs. Vendors, suppliers, and everyone along the logistics train get paid.

It’s almost like libs have never heard of economics.

Some of you libs say it’s elitist to say that there are forms of illiteracy out there. I would encourage you to expand your worldview and read some books that might educate you, absolve your ignorance, reticence, and recalcitrance.

The Millionaire Next Door by Thomas J. Stanley

Future Shock by Alvin Toffler.

Balcony people Joyce Landorf Heatherly

7 Habits of Highly Effective People byStephen Covey.

Please don’t immediately react with the malicious question “Have you read them?????”

Why is it you libs, in addition to being destructively progressive, you are also instinctively reactionary?

Money ABSOLUTELY DOES trickle down. People with money want nice cars, clothes, houses, second houses, renovations, boats. Who does that money trickle down to? Blue collar, and white collar workers filling those jobs. Vendors, suppliers, and everyone along the logistics train get paid.

It’s almost like libs have never heard of economics.

Some of you libs say it’s elitist to say that there are forms of illiteracy out there. I would encourage you to expand your worldview and read some books that might educate you, absolve your ignorance, reticence, and recalcitrance.

The Millionaire Next Door by Thomas J. Stanley

Future Shock by Alvin Toffler.

Balcony people Joyce Landorf Heatherly

7 Habits of Highly Effective People byStephen Covey.

Please don’t immediately react with the malicious question “Have you read them?????”

Why is it you libs, in addition to being destructively progressive, you are also instinctively reactionary?

#46

Senior Member

Thread Starter

The Reagan tax cuts that the “lib’s” love to demonize as “trickle down” ACTUALLY WORKED. Revenues to the treasury immediately doubled. What did the lib’s(with some help by Rino’s) do? They immediately tripled spending. With a race like that, what wins?

Money ABSOLUTELY DOES trickle down. People with money want nice cars, clothes, houses, second houses, renovations, boats. Who does that money trickle down to? Blue collar, and white collar workers filling those jobs. Vendors, suppliers, and everyone along the logistics train get paid.

It’s almost like libs have never heard of economics.

Some of you libs say it’s elitist to say that there are forms of illiteracy out there. I would encourage you to expand your worldview and read some books that might educate you, absolve your ignorance, reticence, and recalcitrance.

The Millionaire Next Door by Thomas J. Stanley

Future Shock by Alvin Toffler.

Balcony people Joyce Landorf Heatherly

7 Habits of Highly Effective People byStephen Covey.

Please don’t immediately react with the malicious question “Have you read them?????”

Why is it you libs, in addition to being destructively progressive, you are also instinctively reactionary?

Money ABSOLUTELY DOES trickle down. People with money want nice cars, clothes, houses, second houses, renovations, boats. Who does that money trickle down to? Blue collar, and white collar workers filling those jobs. Vendors, suppliers, and everyone along the logistics train get paid.

It’s almost like libs have never heard of economics.

Some of you libs say it’s elitist to say that there are forms of illiteracy out there. I would encourage you to expand your worldview and read some books that might educate you, absolve your ignorance, reticence, and recalcitrance.

The Millionaire Next Door by Thomas J. Stanley

Future Shock by Alvin Toffler.

Balcony people Joyce Landorf Heatherly

7 Habits of Highly Effective People byStephen Covey.

Please don’t immediately react with the malicious question “Have you read them?????”

Why is it you libs, in addition to being destructively progressive, you are also instinctively reactionary?

The following users liked this post:

SW20S (06-02-2024)

#49

So in other words all roads will end up being TOLL ROADS??

or how else do they figure mileage?

what happens when you cross state lines?

so CA is getting what they wished for more EVs but did not think f the unintended consequences...

go figure a law maker who does not think.

or how else do they figure mileage?

what happens when you cross state lines?

so CA is getting what they wished for more EVs but did not think f the unintended consequences...

go figure a law maker who does not think.

certain unattainable date. Next day CA announced possible blackouts coming that day because

their grid would be stressed. Can't make this stuff up.

#50

One more thing I have learned over the years, when politicians push something this hard; global warming / climate change, electric vehicles, don't have enough bandwidth

to go through the list, one way or another, you're about to get screwed!

to go through the list, one way or another, you're about to get screwed!

The following users liked this post:

MB2timer (06-03-2024)