2023 S500 Lease Takeover

#26

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,287

Received 3,585 Likes

on

2,049 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

#27

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,287

Received 3,585 Likes

on

2,049 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

Iím not familiar with the idea of selling a lease. Could you please explain a bit?

#28

Super Member

Another dealer took possession of the car and paid off the loan. The reason I didn't sell it to one of my local MB dealers is because they seem to give really low offers because you aren't buying anything from them. The company I used was like a middle-man.

The following users liked this post:

Streamliner (03-11-2023)

#29

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,287

Received 3,585 Likes

on

2,049 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

#30

MBWorld Fanatic!

A correction must still occur and has begun; pricing has stagnated or dropped in many areas, and one or both will continue. Way too much typing to explain it all, a tldr would be to expect prices to remain flat and/or slowly decline throughout this year.

The following users liked this post:

Streamliner (03-12-2023)

#31

The world has changed once again. For the fabulous last 13 years we had QE which was an illusion. Now on to to paying for it with QT. We are now realizing in the real world we can't afford some of this stuff. I hope the contagion stops after SVB and first FTX but things look a bit grime. 5.5% TBills look great to me and no more expensive stuff unless you pay cash.

The following 2 users liked this post by Mbw2468%:

MBNUT1 (03-12-2023),

Streamliner (03-12-2023)

#32

MBWorld Fanatic!

Join Date: Oct 2002

Location: Cincinnati

Posts: 4,229

Received 983 Likes

on

719 Posts

2010 E350 4Matic

The world has changed once again. For the fabulous last 13 years we had QE which was an illusion. Now on to to paying for it with QT. We are now realizing in the real world we can't afford some of this stuff. I hope the contagion stops after SVB and first FTX but things look a bit grime. 5.5% TBills look great to me and no more expensive stuff unless you pay cash.

#33

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

I'm in the residential real estate business, and this is highly localized. Our market here is insane, its every bit as competitive for buyers as it was last year with 5-15 offers on listings and escalations over 10% above asking. This is throughout the area too at all price points spanning from $250k to $2M. The issue is lack of inventory, we just do not have enough housing inventory to meet the demand here in the DC area. There really isn't any such thing as a "national real estate market", its local market to local market. Last week one of my agents lost in competition, there were 28 offers on a house priced at $1.175M and he escalated to $1.475M and lost, the house sold for over $1.5M. Thats happening all over the place, I don't see that ending unless we have a dramatic shift in supply vs demand.

The following users liked this post:

MBNUT1 (03-12-2023)

#35

MBWorld Fanatic!

Join Date: Oct 2002

Location: Cincinnati

Posts: 4,229

Received 983 Likes

on

719 Posts

2010 E350 4Matic

I'm in the residential real estate business, and this is highly localized. Our market here is insane, its every bit as competitive for buyers as it was last year with 5-15 offers on listings and escalations over 10% above asking. This is throughout the area too at all price points spanning from $250k to $2M. The issue is lack of inventory, we just do not have enough housing inventory to meet the demand here in the DC area. There really isn't any such thing as a "national real estate market", its local market to local market. Last week one of my agents lost in competition, there were 28 offers on a house priced at $1.175M and he escalated to $1.475M and lost, the house sold for over $1.5M. Thats happening all over the place, I don't see that ending unless we have a dramatic shift in supply vs demand.

#36

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

The result of that however is not going to be a decrease in home valuesÖ

#37

MBWorld Fanatic!

I'm in the residential real estate business, and this is highly localized. Our market here is insane, its every bit as competitive for buyers as it was last year with 5-15 offers on listings and escalations over 10% above asking. This is throughout the area too at all price points spanning from $250k to $2M. The issue is lack of inventory, we just do not have enough housing inventory to meet the demand here in the DC area. There really isn't any such thing as a "national real estate market", its local market to local market. Last week one of my agents lost in competition, there were 28 offers on a house priced at $1.175M and he escalated to $1.475M and lost, the house sold for over $1.5M. Thats happening all over the place, I don't see that ending unless we have a dramatic shift in supply vs demand.

This is going to continue. There is no relief coming in terms of increased supply, lower rates, or any other meaningful factor. Demand will prevent collapse but it cant stop the already ongoing correction; eventually sellers and buyers have to meet somewhere and the only way for the to happen when buyers are priced out is for real wages to increase or actual costs to decline. Real wages are increasing at a rate lower than inflation. Interest rates will not go down soon, and that leaves pricing with nowhere to go when buyers are priced out. Keep in mind here I'm not talking about million plus dollar apartments in a superheated market, I'm talking all sales. Little people don't buy Dupont Circle lofts at 4.5 but they do buy most of the houses sold.

I'd expect more of the same. Overall pricing will continue to decline until such time as buyer and seller can meet. The have's will continue to buy because they can

#38

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

That's one market; here, closed sales are down almost 19% despite active listings increasing by 83%. In desirable areas you can still see bidding wars but that's the exception now, not the rule, as it had been last summer. Doesn't matter; neither this market nor that market is an economy, which is what she is looking at as a whole. Nationwide the market is stagnating and in some areas is retreating, this is a correction. While marginal buyers are doing their part to hold up pricing they have help; you have people who are priced out or are waiting for more favorable conditions, last year alone billions in dwellings have been picked off by private investment firms, etc.

Keep in mind here I'm not talking about million plus dollar apartments in a superheated market, I'm talking all sales. Little people don't buy Dupont Circle lofts at 4.5 but they do buy most of the houses sold.

I'd expect more of the same. Overall pricing will continue to decline until such time as buyer and seller can meet. The have's will continue to buy because they can

#39

Super Moderator

Join Date: May 2002

Location: Land of 10,000 lakes

Posts: 10,056

Received 3,241 Likes

on

2,018 Posts

AMG GTC Roadster, E63s Ed.1, M8 Comp. Coupe

If this becomes a house-selling discussion, you might want to move this into the off-topic section...

#40

MBWorld Fanatic!

Join Date: Mar 2017

Location: Birmingham, AL

Posts: 1,323

Received 479 Likes

on

331 Posts

2019 S560, 2022 Audi S8

Last edited by MBS63AMG; 03-13-2023 at 07:23 PM. Reason: off topic

#41

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

People have literally been saying that the sky is falling forever, and its yet to come to pass. I'll believe it when I see it.

#42

MBWorld Fanatic!

You obviously weren't there the day the VHS player ate The Little Mermaid. Trust me, that was Armageddon!

This relates to the OP in that the player was in a house with a garage that had a car in it that was leased.

This relates to the OP in that the player was in a house with a garage that had a car in it that was leased.

#43

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

This relates to the OP in that the player was in a house with a garage that had a car in it that was leased.

#44

Super Member

Join Date: Nov 2021

Location: Hong Kong, China

Posts: 893

Received 396 Likes

on

265 Posts

2021 S450 4Matic

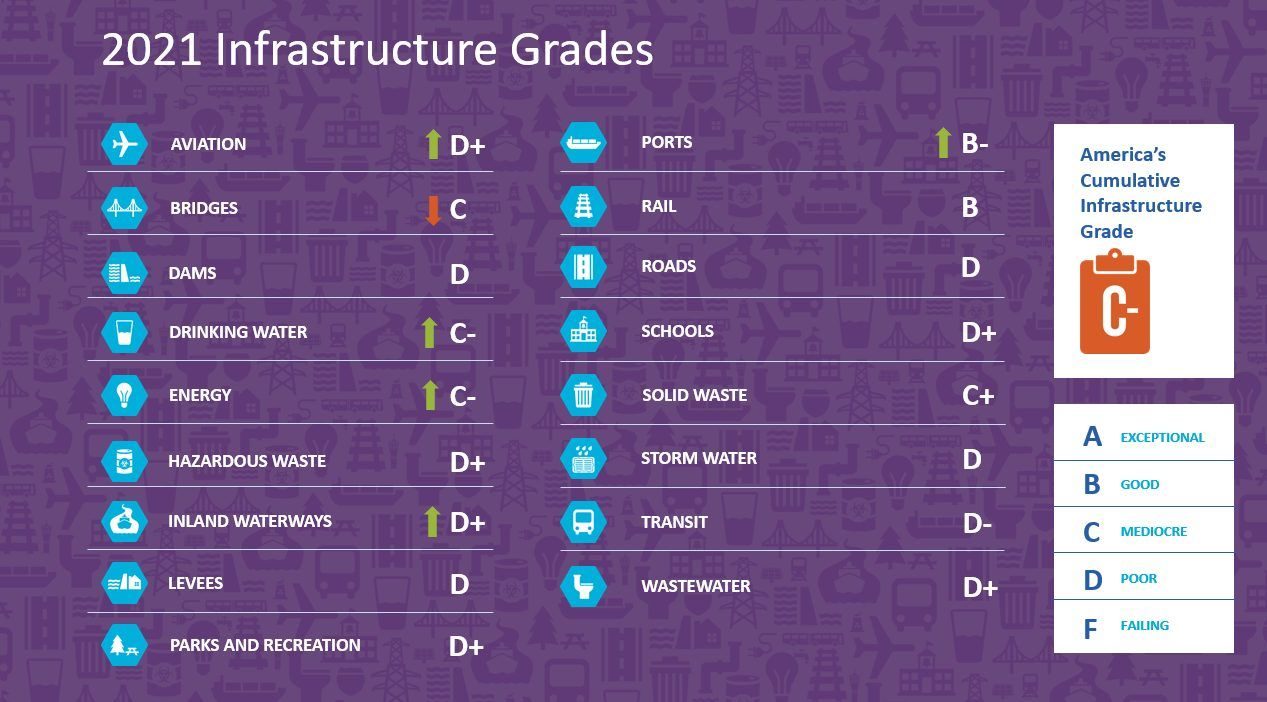

It's about to tank far worse than 2008. The economy is not as good as the Biden bunch want you to think or believe. You cannot sustain the rise in our debt ($36 Trillion) and get away with it. Our infrastructure alone is going to be 30% of our problems along with printing worthless money. Just my opinion but I've seen it coming.

As a civil engineer myself, the infrastructure is one area that is of my concern.

American Society of Civil Engineers (ASCE) assesses the infrastructure on a national scale in a 4-5 year cycle. The latest report card was released in 2021, where the overall score (for all infrastructures in the US) was a 'C-'. This is a slight improvement over the precious report which got a score of 'D+'.

A 3-minute read of the ASCE assessment is here:-

https://www.asce.org/publications-an...investment-gap

A summary of the 2021 report card is here:- (move your mouse over a category and you will see the score)

https://infrastructurereportcard.org/

For the "I-am-too-lazy-to-read" folks, this pic sums it up:-

Personally, I think some scores were a bit too optimistic.

Take the best score 'B' of the Rail category, the condition of the tracks is really in poor shape. There were about 1500 derailments per year from 2005 to 2021. This is serious!

The media often only reports derailments involving radioactive/chemical/biological spills as these cannot be hidden away. Even those reports put the focus at the spill and not the rail/track.

In reality, the overall pic is not so rosy.

The worst grade is the 'D-' of the Transit. The high speed train age has come quite some time ago. Yet Amtrak is still running choo choo trains.

And look at the California High Speed Rail connecting SF and LA. Years and years of delay and the budget keeps increasing exponentially. The design was completed long ago. Then, the politicians wanted to divert the route so that the train will pass through their own towns. This whole thing is a political game for them to grab as much money and self interests as possible.

President Biden might sign a bill of billions to improve infrastructure. But this is just money on a piece of paper. How much money will go to the pockets of his contractor friends and his election sponsors and how much will become asphalt on the road?

Apologize for the off topic.

Last edited by bishop64; 03-13-2023 at 10:21 PM.

#46

Senior Member

Join Date: Mar 2022

Posts: 345

Received 320 Likes

on

175 Posts

2022 S580, Range Rover full sized, retired (Ferraris, lamborghini, Bentley, RR, Porsche etc, etc...)

Enough already! If I want pontifications on the economy I can easily read my WSJ or NYT or listen to the countless talking heads on the tube. I come to this forum to discuss my passion for the S class. Please get back on topic!!

#48

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

#49

Senior Member

So, we are driving S class cars and *****ing about our economy.....sad !

Sorry, but I'm with him....WSJ , NYT and may others are probably the right ones to read.....if necessary !

Sorry, but I'm with him....WSJ , NYT and may others are probably the right ones to read.....if necessary !

#50

MBWorld Fanatic!

Join Date: Jun 2015

Location: Maryland

Posts: 5,370

Received 2,660 Likes

on

1,707 Posts

2020 S560 4Matic

I'd like to be able to continue driving an S class lol