2023 S500 Lease Takeover

#4

Wow so 97k for a lease lol. This is exactly why I bought our 580 executive. I could remember at least twice in the past leasing S500 sedans for 1050 and 1200 a month. These weren't 160k cars like I have now but I remember them being around 120k. It's insane how the lack of promo's, inventive, terrible interest rates, etc. affect the pricing of a lease. I wish you luck finding someone to take this over. Probably better off listing on leasetrader or swapalease

#5

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,380

Received 3,665 Likes

on

2,099 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

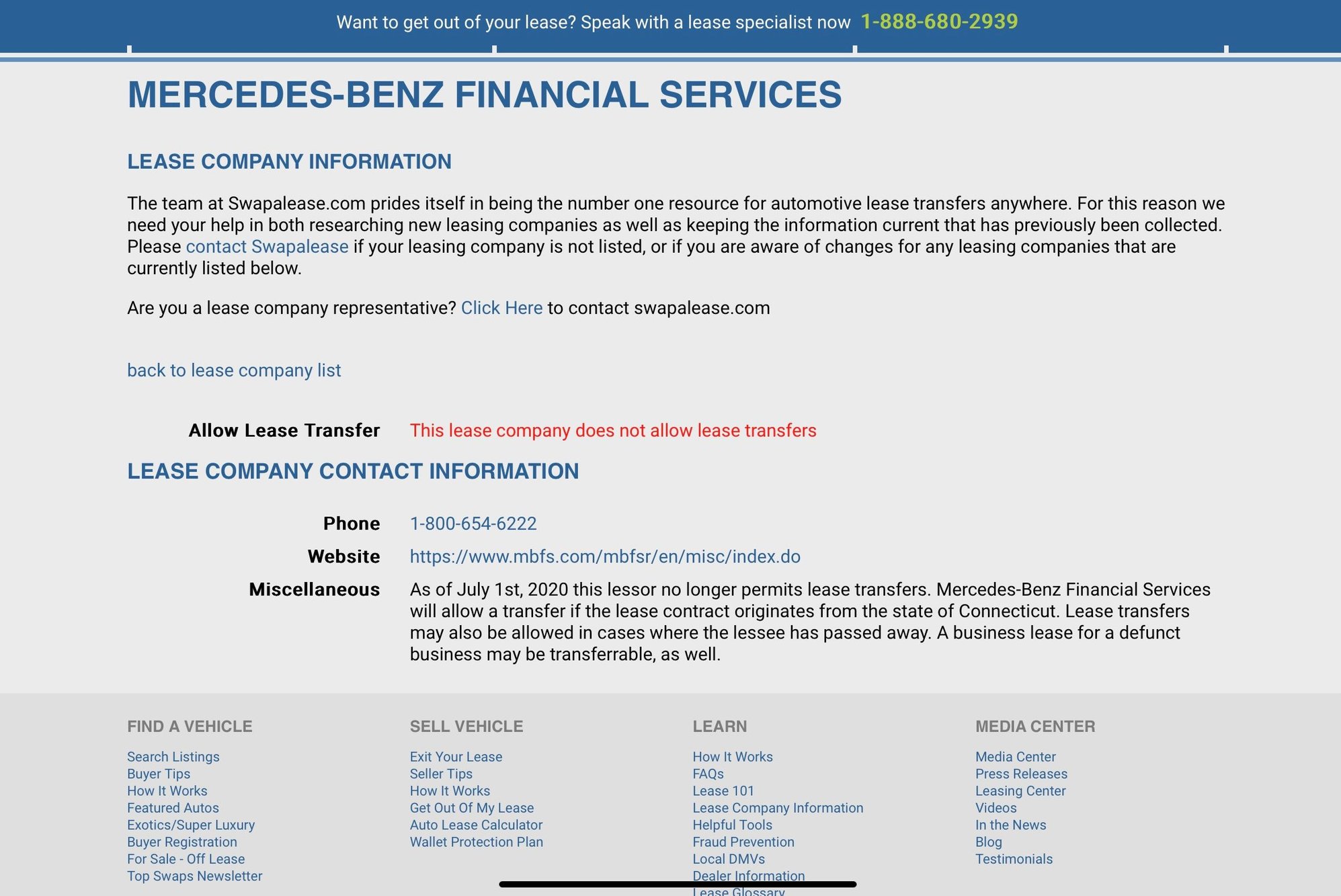

As I posted in the R232 SL forum, where the OP has an SL up for lease assumption, unless there has been a very recent change, if the car is leased through MBFS, they do not allow lease assumptions. You cannot even trade a leased car to a non-MB dealer. The only options to get out of the lease, are to trade it to an MB dealer or to pay off the lease and then you can do whatever. I went through this trying to rid myself of my 2022 S580. No soap! I either pay it off and take a massive loss, or keep it. This MBFS policy really stinks!

Last edited by Streamliner; 03-11-2023 at 10:22 AM.

#6

As I posted in the R232 SL forum, where the OP has an SL up for lease assumption, unless there has been a very recent change, if the car is leased through MBFS, they do not allow lease assumptions. You cannot even trade a leased car to a non-MB dealer. The only options to get out of the lease, are to trade it to an MB dealer or to pay it off the lease and then you can do whatever. I went through this trying to rid myself of my 2022 S580. No soap! I either pay it off and take a massive loss, or keep it. This MBFS policy really stinks!

The following users liked this post:

Streamliner (03-11-2023)

#7

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,380

Received 3,665 Likes

on

2,099 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

Wow so 97k for a lease lol. This is exactly why I bought our 580 executive. I could remember at least twice in the past leasing S500 sedans for 1050 and 1200 a month. These weren't 160k cars like I have now but I remember them being around 120k. It's insane how the lack of promo's, inventive, terrible interest rates, etc. affect the pricing of a lease. I wish you luck finding someone to take this over. Probably better off listing on leasetrader or swapalease

Trending Topics

The following users liked this post:

Streamliner (03-11-2023)

#9

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,380

Received 3,665 Likes

on

2,099 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

Oh wow I didnt realize they stopped allowing lease takeovers. I wonder why they changed there policy, I gotta assume it's better for them to have someone else assume the lease rather then the original leasee go bad. Considering the OP is looking to unload two MB probably some unforeseen financial issue which gets even the best of us from time to time. I didn't even know MB did long leases like this, I shudder to think what this car would have costed on a traditional 36 month lease. I mean your basically paying off the car by the time its over.

I know we have some very astute financial types on this site. What say you? Is the economy going to repeat 2008?

#10

MBWorld Fanatic!

No the economy is not going to repeat 2008

The reason for the change in policy is because of the run up in used car values, people were selling or trading cars in and pocketing big sums over their residuals. MOST lenders also have a similar new policy about where you can trade it in, etc.

The reason for the change in policy is because of the run up in used car values, people were selling or trading cars in and pocketing big sums over their residuals. MOST lenders also have a similar new policy about where you can trade it in, etc.

The following 2 users liked this post by SW20S:

DoctorDash (03-11-2023),

QuadBenz (03-11-2023)

#11

MBWorld Fanatic!

He also mentioned a 52 month term. Does MB even offer leases that long, beyond the warranty?

His payments are high because interest rates (money factors) are killer right now and they may in fact go higher. If interest rates drop in the next few years, I’ll likely buy out my lease and finance.

His payments are high because interest rates (money factors) are killer right now and they may in fact go higher. If interest rates drop in the next few years, I’ll likely buy out my lease and finance.

#12

MBWorld Fanatic!

Irrespective of the reason it's a shame MBFS does not allow lease assumption. The flexibility of either moving on from your lease early to look at another brand, or if you just need out of the lease, or, as in my case currently, looking to get into a car in this class at a better lease rate than current is a nice option.

#13

MBWorld Fanatic!

That's one of the worst leases I've ever seen. A lot of people are in the same boat that leased during the inflated values period and I feel for them. Although, I would never have signed that lease...

#14

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,380

Received 3,665 Likes

on

2,099 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

Back then, as recently as early to mid 2007, the economy was still strong. In a few months, the bottom fell out. Why do you think it won’t happen this time around? They just closed a bank yesterday. Seems like the ice is starting to crack under the economy.

#15

MBWorld Fanatic!

Join Date: Apr 2019

Location: Scottsdale AZ

Posts: 1,564

Received 448 Likes

on

357 Posts

2015 CLS 550 2015 ML 400 Previous 2020 GLB 250 2019 A 220 2005 ML 350 1989 300 E 2001 SL 500

I am no financial guru, but I keep hearing that we are headed into some very tough economic times. If a customer can no longer afford a lease, one would really think that MB would just LOVE to have it assumed by a “well qualified” party, instead of having to repossess a vehicle.

I know we have some very astute financial types on this site. What say you? Is the economy going to repeat 2008?

I know we have some very astute financial types on this site. What say you? Is the economy going to repeat 2008?

As for the economy, the jobs market is still good. Inflation is high and rates are rising. People will adjust to the rates. I think we all got spoiled by the historically low rates we've had for the last decade or so. I don't see a collapse like 2008 coming.

The following users liked this post:

AMG350 (03-11-2023)

#16

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,380

Received 3,665 Likes

on

2,099 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

I don’t believe that for a minute. That sounds like an MBFS talking point to me.

#17

MBWorld Fanatic!

Lol, no question. They didn't like leasers profiting and moved to keep it in house.

The following users liked this post:

Streamliner (03-11-2023)

#18

MBWorld Fanatic!

Originally Posted by Streamliner;[url=tel:8737264

8737264]Back then, as recently as early to mid 2007, the economy was still strong. In a few months, the bottom fell out. Why do you think it won’t happen this time around? They just closed a bank yesterday. Seems like the ice is starting to crack under the economy.

I bought a townhouse in 2007 and they never asked me for one bank statement, not one income document. It was like buying a car. Getting a mortgage today is dramatically different. Those mortgages were sold off as securities and basically everyone and everything was heavily invested in them and they wound up having no value once people started to default.

The following 2 users liked this post by SW20S:

rnpalmer (03-12-2023),

Streamliner (03-11-2023)

#19

MBWorld Fanatic!

Originally Posted by Frenetic;[url=tel:8737248

8737248]He also mentioned a 52 month term. Does MB even offer leases that long, beyond the warranty?

His payments are high because interest rates (money factors) are killer right now and they may in fact go higher. If interest rates drop in the next few years, I’ll likely buy out my lease and finance.

His payments are high because interest rates (money factors) are killer right now and they may in fact go higher. If interest rates drop in the next few years, I’ll likely buy out my lease and finance.

Stay tuned for 45 year mortgages

Last edited by SW20S; 03-11-2023 at 01:08 PM.

The following 2 users liked this post by SW20S:

Frenetic (03-11-2023),

Streamliner (03-11-2023)

#20

MBWorld Fanatic!

Because the fundamentals of the economy are nothing like they were in 2007. In 2007 you had these mortgage backed securities which had become intertwined in every area of the economy, and they were fundamentally worthless because the consumers had taken out mortgages they couldn’t afford. Banks had basically just stopped qualifying people giving everybody mortgages and they had stopped using private mortgage insurance to protect them from default out of greed.Fast forward to today, none of that has happened.

I bought a townhouse in 2007 and they never asked me for one bank statement, not one income document. It was like buying a car. Getting a mortgage today is dramatically different. Those mortgages were sold off as securities and basically everyone and everything was heavily invested in them and they wound up having no value once people started to default.

I bought a townhouse in 2007 and they never asked me for one bank statement, not one income document. It was like buying a car. Getting a mortgage today is dramatically different. Those mortgages were sold off as securities and basically everyone and everything was heavily invested in them and they wound up having no value once people started to default.

Not all roses though: In the near term the loss of potash and phosphate precipitated by the Ukraine war is going to create a worldwide shortage of food. That's should be seen as inflationary at best, in human terms it's much worse. Also inflationary is the move to green: Materials need to be produced in quantities that exceed the current supply chain, in some cases by a factor of ten. That's mining, then building the refining/processing capacity, then building out the supply chain. All along the way there will be shortages of those materials and pricing will be set by marginal buyers with knock on effects from the many related industries. Then you've got energy which is going to get worse before it gets better. She tells me to expect inflation to be stubborn in the near term and the longer term is an unknown.

The following users liked this post:

Streamliner (03-11-2023)

#21

MBWorld Fanatic!

Join Date: Oct 2010

Location: Corona Del Mar, CA

Posts: 7,380

Received 3,665 Likes

on

2,099 Posts

2020 S560 Sedan, 2019 SL450, 2019 E450 Luxury Trim Wagon, '24 BMW I7 on order...

#22

MBWorld Fanatic!

if anyone is in the market for a new car over the next year, and wants to lease or finance, I would try and do it sooner rather than later. It would not surprise me if interest rates continued to climb. We have been spoiled with ultra low rates over the last decade. Prior to the housing crisis, rates were much higher.

The following 2 users liked this post by Frenetic:

jsoloddss65 (03-12-2023),

MBNUT1 (03-12-2023)

#23

Keep in mind what initiated the 2008 Meltdown. No Documentation mortgage loans. A waitress in Phoenix owned 5 homes and never made a monthly payment. When foreclosure started she sold the home, took her gained equity and bought another. Investment bankers put together Collateralized Loan Obligations CDOs. Real Estate had a tremendous history of never/rarely losing value. So the investment in a Collateralized pool of mortgages was deemed pretty safe. The Bankers came up with Credit Default Swaps CDSs. If a CDO failed the CDS would take possession, like insurance, except that the CDSs were not required to have reserves to cover them like insurance companies are required to have. Therefore the name of Swap instead of Credit default Insurance. Bear Stearns, Lehman Bros, AIG experienced huge losses carrying the CDS. That was the start to that meltdown.

Now we have banks like SVB that had a huge portfolio of long term Gov’t bonds yielding 1 - 1-1/2% (very low rates) and now Powell has rapidly increased the Federal Funds Rate causing the short term Treasuries to rise above 5%. Imagine how many savers are dumping passbook and CDs and buying 6 mo T-Bills which yesterday morning yielded 5.2%, closed yesterday at 5.04%. SVB had to sell their Long Term Treasuries to provide liquidity for the withdrawals, they lost over $1 Billion, therefore was deemed insolvent and taken over by the Feds.

How many other banks will realize this same transfer of $$$$? I hope not many BUT the next 2 months will give us much more comfort or fear.

The Feds said last year inflation was transitory. We continue to see rising prices. Energy, Food and most staples. Credit card debt at a record $930.6 Billion (last month report).

Google how much the U.S. printed in U.S. currency since 2020. That will astound you!!

Google M1 and M2 money supply. That is inflationary.

Who knows what is ahead of us but we sure do see a lot of questioning statistics.

Now we have banks like SVB that had a huge portfolio of long term Gov’t bonds yielding 1 - 1-1/2% (very low rates) and now Powell has rapidly increased the Federal Funds Rate causing the short term Treasuries to rise above 5%. Imagine how many savers are dumping passbook and CDs and buying 6 mo T-Bills which yesterday morning yielded 5.2%, closed yesterday at 5.04%. SVB had to sell their Long Term Treasuries to provide liquidity for the withdrawals, they lost over $1 Billion, therefore was deemed insolvent and taken over by the Feds.

How many other banks will realize this same transfer of $$$$? I hope not many BUT the next 2 months will give us much more comfort or fear.

The Feds said last year inflation was transitory. We continue to see rising prices. Energy, Food and most staples. Credit card debt at a record $930.6 Billion (last month report).

Google how much the U.S. printed in U.S. currency since 2020. That will astound you!!

Google M1 and M2 money supply. That is inflationary.

Who knows what is ahead of us but we sure do see a lot of questioning statistics.

The following 4 users liked this post by kenromero:

#24

MBWorld Fanatic!

#25

Super Member

I sold my lease to Lease Ninjas. They have contacts with several different dealer brands and can arrange a dealer to purchase your lease since most auto manufacturer banks no longer allow 3rd party lease buy-outs. Also, I believe MBFS goes up to 60 month leases.