Bye Bye Tax Credit for Mercedes EQ's

#1

MBWorld Fanatic!

Thread Starter

Bye Bye Tax Credit for Mercedes EQ's

The Senate has passed the Inflation Reduction Act

https://electrek.co/2022/08/07/senat...ate-bill-ever/

This will extend the $7500 credit for EVs assembled in North America and end the current $7500 credit for all others.

If you can pick up your EQS before the house passes it and Biden signs it into law then make it happen!

I think the EQS SUV will still be eligible? Correct me if I am wrong please.

https://electrek.co/2022/08/07/senat...ate-bill-ever/

This will extend the $7500 credit for EVs assembled in North America and end the current $7500 credit for all others.

If you can pick up your EQS before the house passes it and Biden signs it into law then make it happen!

I think the EQS SUV will still be eligible? Correct me if I am wrong please.

#2

Super Member

SUV price capped at $80k for tax credit. Car price capped at $55k.

Income is capped at $150k/300k for credit.

There’s also stipulations about location of vehicle’s final assembly and where the batteries are manufactured.

From what I’m reading, there’s literally only about half a dozen EVs that will qualify for tax credit with this new bill.

Income is capped at $150k/300k for credit.

There’s also stipulations about location of vehicle’s final assembly and where the batteries are manufactured.

From what I’m reading, there’s literally only about half a dozen EVs that will qualify for tax credit with this new bill.

#3

Member

If the battery size is still used to determine the amount of credit the F-150 and Silverado may be the only ones to max. Not much has been said, but I wonder about what restrictions they have on the used EV credit.

#4

Junior Member

Join Date: Jan 2022

Posts: 53

Likes: 0

Received 15 Likes

on

12 Posts

2022 EQS 580 4matic, 2022 GLS 450

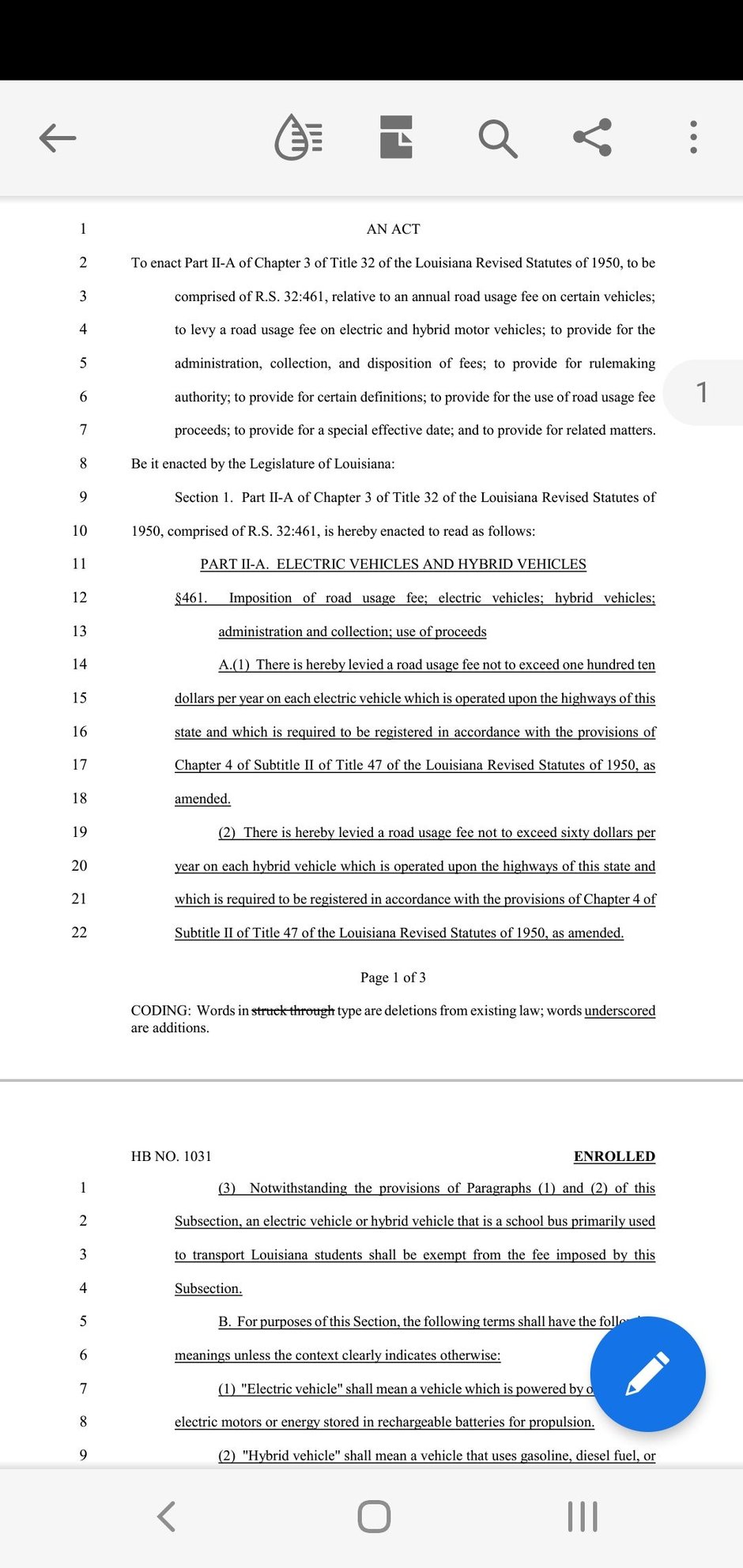

In addition to the Federal EV tax loss, my state has eliminated their EV tax refund offer and added an additional road tax on all EV vehicles and hybrids! How is that supposed to encourage a switch?

Last edited by rbourge; 08-08-2022 at 11:43 AM.

The following users liked this post:

taybae (08-23-2022)

#5

Super Member

The following 2 users liked this post by Newbyloub:

hyperion667 (08-08-2022),

MBNUT1 (08-08-2022)

#6

MBWorld Fanatic!

Thread Starter

Yeah they really watered the tax credit down. I just wish they left the old one in place until each company reached their 200,000 limit.

Also I believe there is an income limit as well. So a lot of buyers who claim this credit may not even be able to get all $7500.

Also I believe there is an income limit as well. So a lot of buyers who claim this credit may not even be able to get all $7500.

The following users liked this post:

taybae (08-23-2022)

#7

Out Of Control!!

Join Date: Sep 2018

Location: unbegrenzt

Posts: 13,446

Received 3,978 Likes

on

3,127 Posts

2017 GLE350 4MATIC

In addition to the issue of skirting road tax, electric utilities are not of one mind as to if, when and how to supply electricity for the new world of EVs, if it ever arrives.

Tapping the brakes on EV penetration, as this bill does, helps governments keep their eye on the tax ball and the utilities to rustle up a plan to bring more juice.

Tapping the brakes on EV penetration, as this bill does, helps governments keep their eye on the tax ball and the utilities to rustle up a plan to bring more juice.

The following users liked this post:

hyperion667 (08-08-2022)

Trending Topics

#8

Super Member

Join Date: Mar 2022

Location: South by Southwest

Posts: 523

Received 205 Likes

on

158 Posts

2021 AMG E63s Wagon

No Free Lunch

Some EVs are so expensive now they should be part of the mortgage as an appliance or backup generator?

When 2020 CRV Hybrid finally dies wife's next vehicle has to be an EV. As an engineer would prefer a Hydrogen Fuel Cell vehicle but infrastructure not there yet. The way this country works as we phase out ICE the cost to charge EVs will creep up to what we used to pay for Diesel and Gasoline especially with all these incentives going away. States and Feds need to Tax charging to help pay for roads and graft. Insurance cost are also insane especially at GA residence. My 3 ICE vehicles in NM that take premium octane, cost less to insure than 2021 Kia Soul in Athens area of Georgia. 18-year old son partly to blame since is on GA policy but main culprit is our proximity to Atlanta Georgia so says our Agent in Watkinsville. Can only imagine what Tesla's or EQS SUV's Premium would cost @stealth.pilot ? Told the wife no more free lunch and needs to start saving up for her future transportation...lol

I will keep air in the tires and might help with insurance. Georgia taxes half my NM retirement income but at least I'm covered under her Government Health Insurance for now. I might buy a Zero Motorcycle if my balance is still good in 8-13 years. Will continue to enjoy all the pops from my Toys until I'm forced to downsize and relocate back East after 70 and old job no longer requires my part time services for contract. Hope wife transfers to DMV area in a Tax friendly location. Maybe WV or DE?

When 2020 CRV Hybrid finally dies wife's next vehicle has to be an EV. As an engineer would prefer a Hydrogen Fuel Cell vehicle but infrastructure not there yet. The way this country works as we phase out ICE the cost to charge EVs will creep up to what we used to pay for Diesel and Gasoline especially with all these incentives going away. States and Feds need to Tax charging to help pay for roads and graft. Insurance cost are also insane especially at GA residence. My 3 ICE vehicles in NM that take premium octane, cost less to insure than 2021 Kia Soul in Athens area of Georgia. 18-year old son partly to blame since is on GA policy but main culprit is our proximity to Atlanta Georgia so says our Agent in Watkinsville. Can only imagine what Tesla's or EQS SUV's Premium would cost @stealth.pilot ? Told the wife no more free lunch and needs to start saving up for her future transportation...lol

I will keep air in the tires and might help with insurance. Georgia taxes half my NM retirement income but at least I'm covered under her Government Health Insurance for now. I might buy a Zero Motorcycle if my balance is still good in 8-13 years. Will continue to enjoy all the pops from my Toys until I'm forced to downsize and relocate back East after 70 and old job no longer requires my part time services for contract. Hope wife transfers to DMV area in a Tax friendly location. Maybe WV or DE?

Last edited by Drone_S213; 08-08-2022 at 01:03 PM.

#9

MBWorld Fanatic!

Join Date: Jun 2010

Location: Atlanta

Posts: 2,555

Received 815 Likes

on

523 Posts

2022 Mercedes EQS 580

Some EVs are so expensive now they should be part of the mortgage as an appliance or backup generator?

When 2020 CRV Hybrid finally dies wife's next vehicle has to be an EV. As an engineer would prefer a Hydrogen Fuel Cell vehicle but infrastructure not there yet. The way this country works as we phase out ICE the cost to charge EVs will creep up to what we used to pay for Diesel and Gasoline especially with all these incentives going away. States and Feds need to Tax charging to help pay for roads and graft. Insurance cost are also insane especially at GA residence. My 3 ICE vehicles in NM that take premium octane, cost lass to insure than 2021 Kia Soul in Athens area of Georgia. 18-year old son partly to blame since is on GA policy but main culprit is our proximity to Atlanta Georgia so says our Agent in Watkinsville. Can only imagine what Tesla's or EQS SUV's Premium would cost @stealth.pilot ? Told the wife no more free lunch and needs to start saving up for her future transportation...lol

I will keep air in the tires and might help with insurance. Georgia taxes half my NM retirement income but at least I'm covered under her Government Health Insurance for now. I might buy a Zero Motorcycle if my balance is still good in 8-13 years. Will continue to enjoy all the pops from my Toys until I'm forced to downsize and relocate back East after 70 and old job no longer requires my part time services for contract. Hope wife transfers to DMV area in a Tax friendly location. Maybe WV or DE?

When 2020 CRV Hybrid finally dies wife's next vehicle has to be an EV. As an engineer would prefer a Hydrogen Fuel Cell vehicle but infrastructure not there yet. The way this country works as we phase out ICE the cost to charge EVs will creep up to what we used to pay for Diesel and Gasoline especially with all these incentives going away. States and Feds need to Tax charging to help pay for roads and graft. Insurance cost are also insane especially at GA residence. My 3 ICE vehicles in NM that take premium octane, cost lass to insure than 2021 Kia Soul in Athens area of Georgia. 18-year old son partly to blame since is on GA policy but main culprit is our proximity to Atlanta Georgia so says our Agent in Watkinsville. Can only imagine what Tesla's or EQS SUV's Premium would cost @stealth.pilot ? Told the wife no more free lunch and needs to start saving up for her future transportation...lol

I will keep air in the tires and might help with insurance. Georgia taxes half my NM retirement income but at least I'm covered under her Government Health Insurance for now. I might buy a Zero Motorcycle if my balance is still good in 8-13 years. Will continue to enjoy all the pops from my Toys until I'm forced to downsize and relocate back East after 70 and old job no longer requires my part time services for contract. Hope wife transfers to DMV area in a Tax friendly location. Maybe WV or DE?

The following users liked this post:

Radman991 (08-08-2022)

#13

MBWorld Fanatic!

Join Date: Nov 2018

Location: San Francisco Bay Area

Posts: 8,598

Received 3,938 Likes

on

2,629 Posts

2019 C63CS

They indirectly do. The gas tax is tied to how much gas you use, not how many miles you drive. A car that burns more fuel and therefore pollutes more will pay more in taxes for a given distance than a more fuel efficient and less polluting car such as a hybrid. The issue is how the tax dollars are allocated. Are they used to clean up the environment or purely for road constructions or do they end up in the coffers of corrupt politicians.

#15

The Senate has passed the Inflation Reduction Act

https://electrek.co/2022/08/07/senat...ate-bill-ever/

This will extend the $7500 credit for EVs assembled in North America and end the current $7500 credit for all others.

If you can pick up your EQS before the house passes it and Biden signs it into law then make it happen!

I think the EQS SUV will still be eligible? Correct me if I am wrong please.

https://electrek.co/2022/08/07/senat...ate-bill-ever/

This will extend the $7500 credit for EVs assembled in North America and end the current $7500 credit for all others.

If you can pick up your EQS before the house passes it and Biden signs it into law then make it happen!

I think the EQS SUV will still be eligible? Correct me if I am wrong please.

#16

Super Member

I get the optics, some people may feel that those who can afford spending a 100k+ On a Car in cash to buy the vehicle without a lien shouldnít be entitled to a $7500 tax break. This may affect other cheaper Mercedes EQ models down the lineup. I do think that EV skeptics in the luxobarge category (like me previously) will be less likely to consider EQS. The tax break definitely sweetened the pot for me and cemented the decision on an EQS. Otherwise, I might have leaned toward S580 or the newer updated S8 to replace my A8.

I have an Ď18 S560 that I like very much

When the EQS was announced, I decided I wanted one, I had the $, the &7,500 credit was an added benefit that had nothing to do with my buy decision, so I bought my 450.

Iím very content.

Last edited by Newbyloub; 08-10-2022 at 05:58 AM.

#17

Member

I was notified just today that we have an allocation for a mid November build. Car should be delivered by the end of December if we don’t run into any holds. It’s coming through Brunswick VPC. Can I get a binding purchase agreement or does the car need to be built? I hope I can get the $7500 credit.

#18

MBWorld Fanatic!

I was notified just today that we have an allocation for a mid November build. Car should be delivered by the end of December if we donít run into any holds. Itís coming through Brunswick VPC. Can I get a binding purchase agreement or does the car need to be built? I hope I can get the $7500 credit.

#19

MBWorld Fanatic!

Thread Starter

I was notified just today that we have an allocation for a mid November build. Car should be delivered by the end of December if we donít run into any holds. Itís coming through Brunswick VPC. Can I get a binding purchase agreement or does the car need to be built? I hope I can get the $7500 credit.

#20

Super Member

Join Date: Dec 2014

Location: New England/Florida

Posts: 702

Received 152 Likes

on

114 Posts

2005 SL 500. 2015 S550. 2016 GLE400 2018 S560

So does that mean you donít actually have to have the car in your possession? I have a vin number and my car has been sitting at the German port for over 3 weeks waiting for a ship assignment. Talk about bad luck after waiting for over a year to get a build.

#21

This has some info that hopefully that maybe helpful to you to secure a "binding agreement" from your dealer, but there is no guarantee. I hope you get your credit. IMO you definitely deserve it given your wait time, the income cut offs and price limits that eliminate the EV tax credits are unfortunate.

#22

MBWorld Fanatic!

Join Date: Apr 2019

Location: Scottsdale AZ

Posts: 1,564

Received 448 Likes

on

357 Posts

2015 CLS 550 2015 ML 400 Previous 2020 GLB 250 2019 A 220 2005 ML 350 1989 300 E 2001 SL 500

If you go ahead and pay for the car, and have a buyers order dated prior to the new law passing you should be fine.

#23

MBWorld Fanatic!

Thread Starter

This is the information I read. Most seem to think that this is correct. I do not know if there is anything written anywhere to specifically confirm this belief.

Last edited by Tjdehya; 08-11-2022 at 08:03 PM.

The following users liked this post:

Radman991 (08-11-2022)

#25

Member

Thanks. I forwarded this to my SA. I’m going to discuss this tomorrow. We ordered the car in January. I was starting to think it wouldn’t be made until next year. We started out at 16 and then the past two months we’ve been sitting at 3.